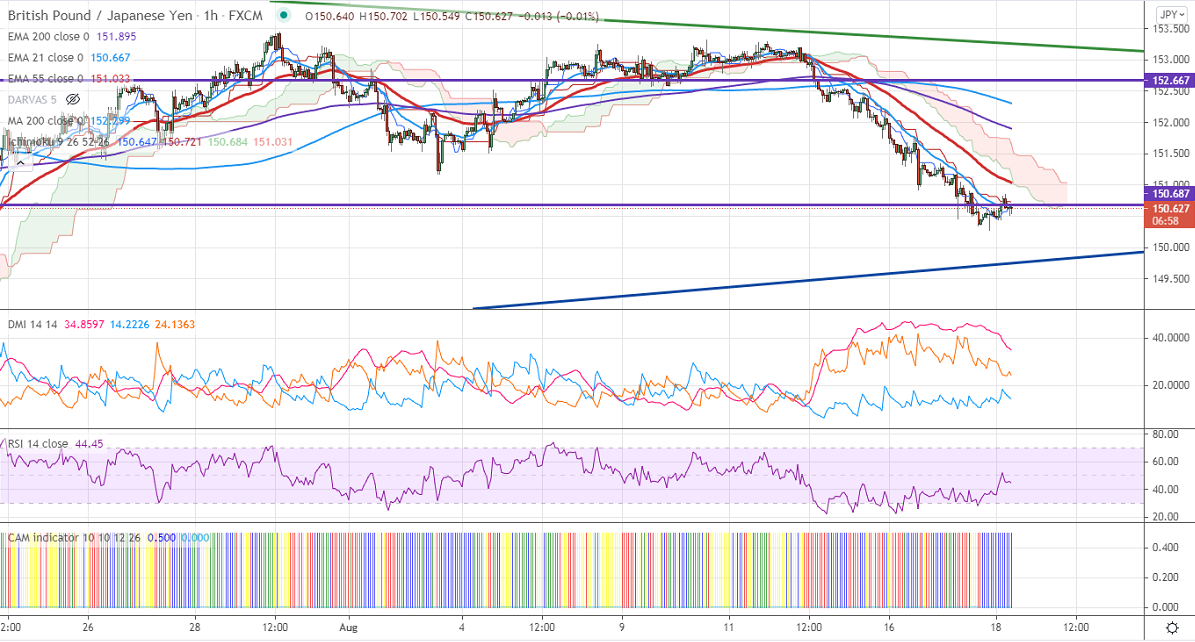

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 150.64

Kijun-Sen- 150.72

Previous week high – 153.45

GBPJPY was one of the worst performers this week and lost more than 100 pips on the weak Pound sterling. GBPUSD is inching towards 1.3700 levels after UK CPI misses the estimate. The annualized inflation came at 1.8% in July compared to a forecast of 2%. The Japanese yen has taken support near multi-month low 109 and bounced above 109.50. The intraday trend of GBPJPY is bearish as long as resistance 151.55 holds.

Technical:

The pair's immediate resistance is around 151, any jump above targets 151.55/152/152.50. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 150.60. Any indicative violation below targets 150/149.

Ichimoku Analysis- The pair is trading below Kijun-Sen and Tenken-Sen.

Indicator (Daily chart)

CAM indicator-Neutral

Directional movement index –Slightly bullish

It is good to sell on rallies around 151.95-152 with SL around 152.80 for a TP of 150.65.