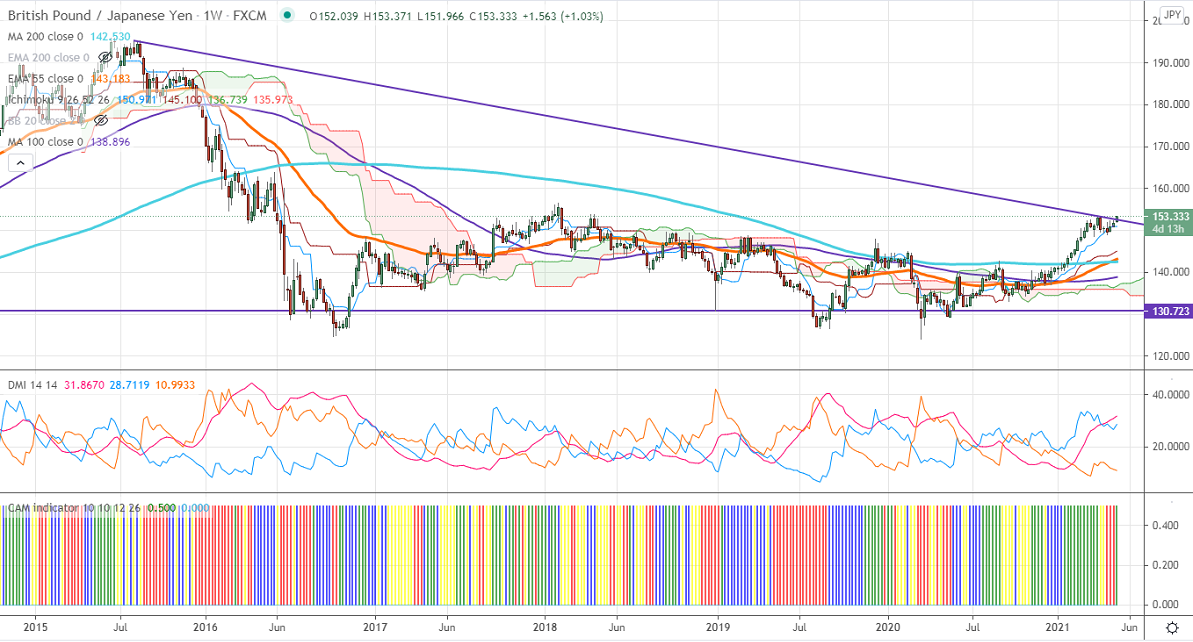

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- 150.97

Kijun-Sen- 144.58

GBPJPY continues to trade higher for a third consecutive week and breaks significant resistance 152.40. The pair surged mainly due to the strong Pound sterling. GBPUSD hits a three-month high above 1.4050 on UK political update. Markets eye UK Final GDP and BOE Bailey speech this week for further direction. USDJPY has recovered sharply after a dip till 108.33 on a surge in US bond yield. The US 10-year bond yield surged more than 8% from minor bottom 1.48%. The intraday trend of GBPJPY is bullish as long support 152.35 holds.

Technical:

The pair's near-term resistance is around 153.40 (Apr 6th high), any break above will take the pair to the next level until 154.55/156. On the lower side, near-term support is around 152.35. Any indicative violation below that level will drag the pair down to 151.70/151.10/150.80/150.30. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above weekly Kijun-Sen and below Tenken-Sen, cloud.

Indicator (Weekly chart)

CAM indicator –bullish

Directional movement index –Bullish

It is good to buy on dips around 152.70-75 with SL around 152 for a TP of 155.