GBPJPY continues to trade weak for second consecutive week. It hits a high of 188.13 and is currently trading around 184.38.

Markets eye BOE monetary policy and US Fed policy this week for further direction.

Technicals-

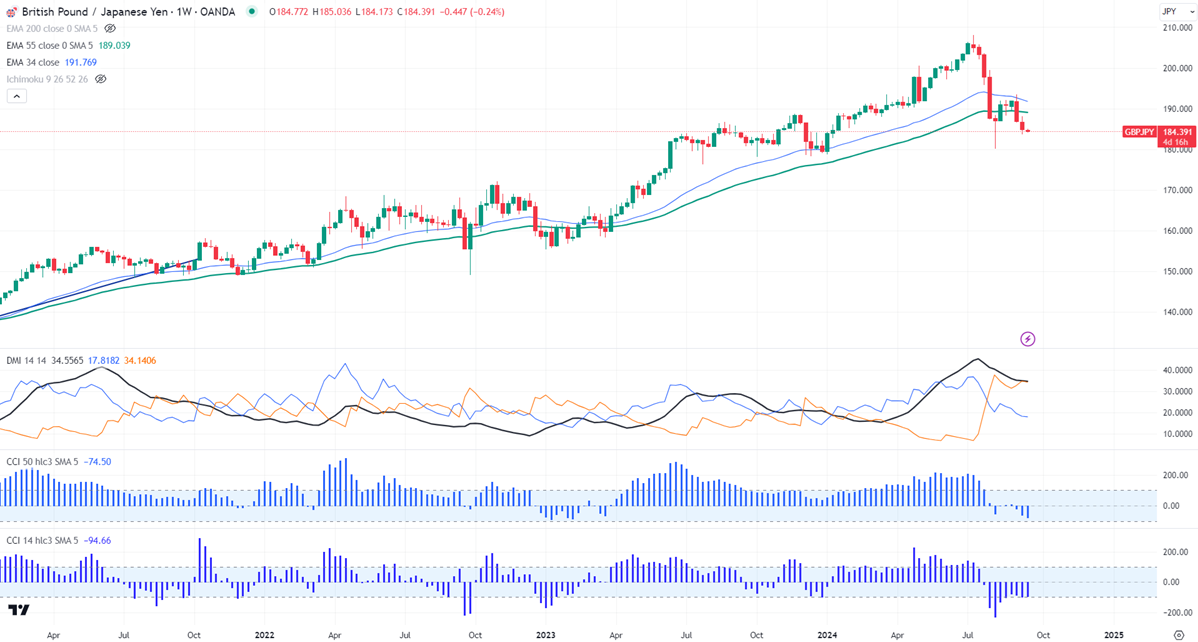

The pair trades below short-term 34, below 55 EMA (186.99 and 187.79), and long-term 200 EMA (190.78) in the weekly chart.

The near-term resistance is around 185.40,a breach above targets 186.05/187/187.74 (23,6% fib)/188.13 (Sep 9th high).Major trend continuation only above 190. The immediate support is at 183.70, any violation below will drag the pair to 183./181.87/180.

Indicator (Weekly chart)

CCI (14)- Bearish

CCI (50)- Bearish

Average directional movement Index - Neutral. All indicators confirm a bearish trend.

It is good to sell on rallies around 185.18-20 with SL around 186.70 for a TP of 180.40.