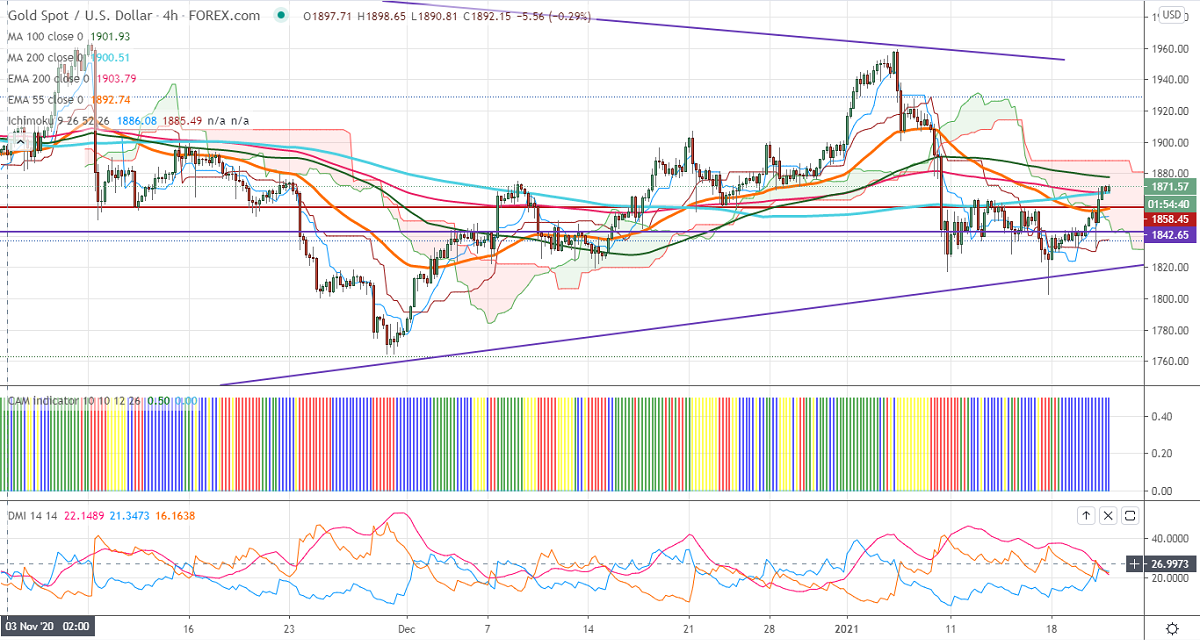

Ichimoku analysis (4 Hour chart)

Tenken-Sen- $1852.37

Kijun-Sen- $1837.43

Gold showed a massive jump of nearly $ 40 as new President Biden would provide more stimulus to counter the Coronavirus pandemic. The US 10- year yield declined 9% after hitting a 10-month high at 1.184%. US dollar index continues to trade weak for the second consecutive day, any violation below 89.80 confirms bearish continuation. Markets eye ECB monetary policy, Philly fed manufacturing, and jobless claims.

Technical:

The yellow metal faces strong support at $1857, violation below targets $1845/$1830/$1818 (61.8% fib)/$1800. Significant trend reversal if it breaks below $1800.On the higher side, near term resistance is around $1878 (200-4- H MA), any indicative break above that level will take till $1900.

It is good to buy on dips around $1850-51 with SL around $1838 for the TP of $1900.