FxWirePro: Gold Daily Outlook

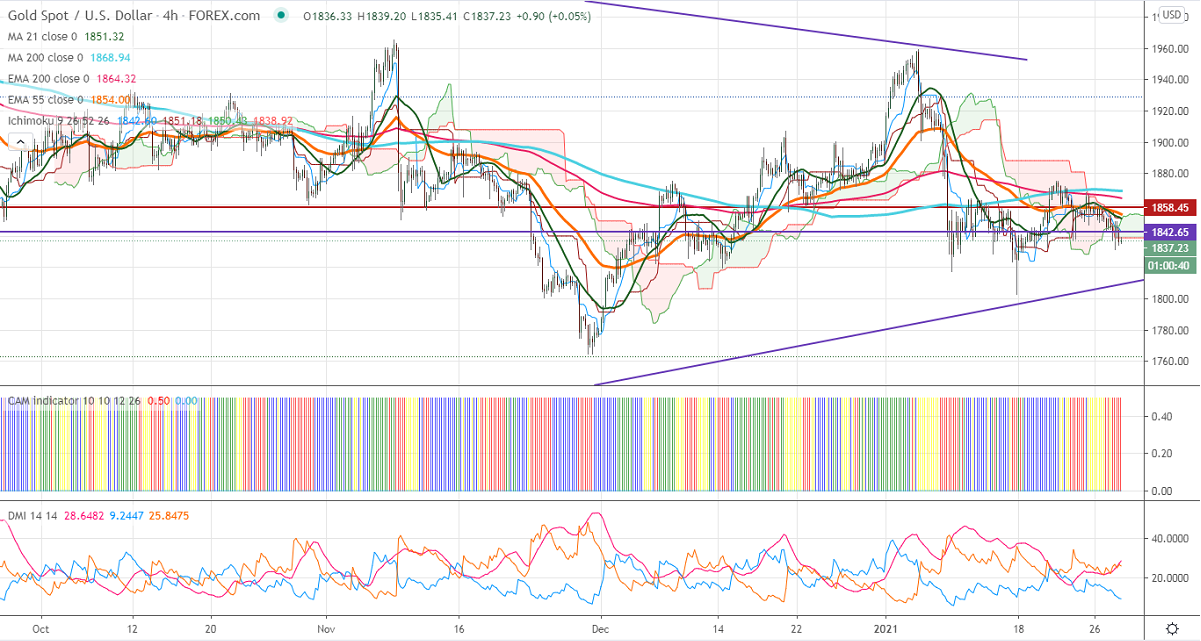

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1844.89

Kijun-Sen- $1851.54

Gold is trading weak and lost more than $20 on the strong US dollar. The Fed has kept its rates unchanged and said that economic growth will depend on the further spread of the virus and progress of vaccine. DXY recovered sharply, any bullish continuation only above 91 levels.

Technical:

It is facing strong support at $1830, violation below targets $1820/$1800.On the higher side, near term resistance is around $1855, any indicative break above that level will take till $1860/$1865/$1875/$1885/$1900.

It is good to sell on rallies around $1850 with SL around $1860 for the TP of $1800