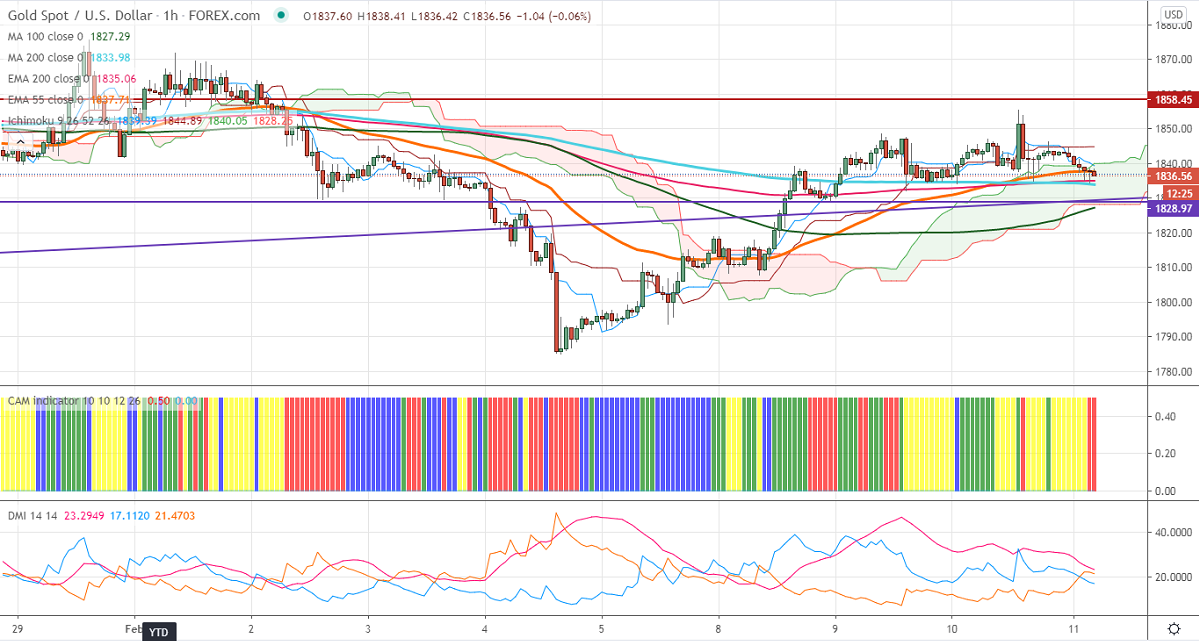

Ichimoku analysis (Hourly Chart)

Tenken-Sen- $1840.32

Kijun-Sen- $ 1844

Gold has lost more than $20 on upbeat market sentiment. US Fed Chairman Powell was cautiously optimistic and said that the central bank is to continue aggressive policy till the employment problem gets over. The short term trend is still neutral as long as resistance $1860 holds. US dollar index continues to trade lower for fourth consecutive days; violation below 91 confirms further weakness.

Economic data:

US core inflation for Jan (MoM) came at 0% compared to expectations of 0.2%. The headline inflation in line with expectations for Jan at 0.3%. US 10- year yield lost more than 4.5% amid soft inflation data.

Technical:

The yellow metal is facing strong resistance at $1860. Any violation above that level confirms minor bullishness, a jump till $1875 likely.

On the lower side, near term support is around $1830, any indicative break below that level will take till $1820/$1800/$1780.

It is good to buy on dips around $1832-33 with SL around $1818 for the TP of $1900.