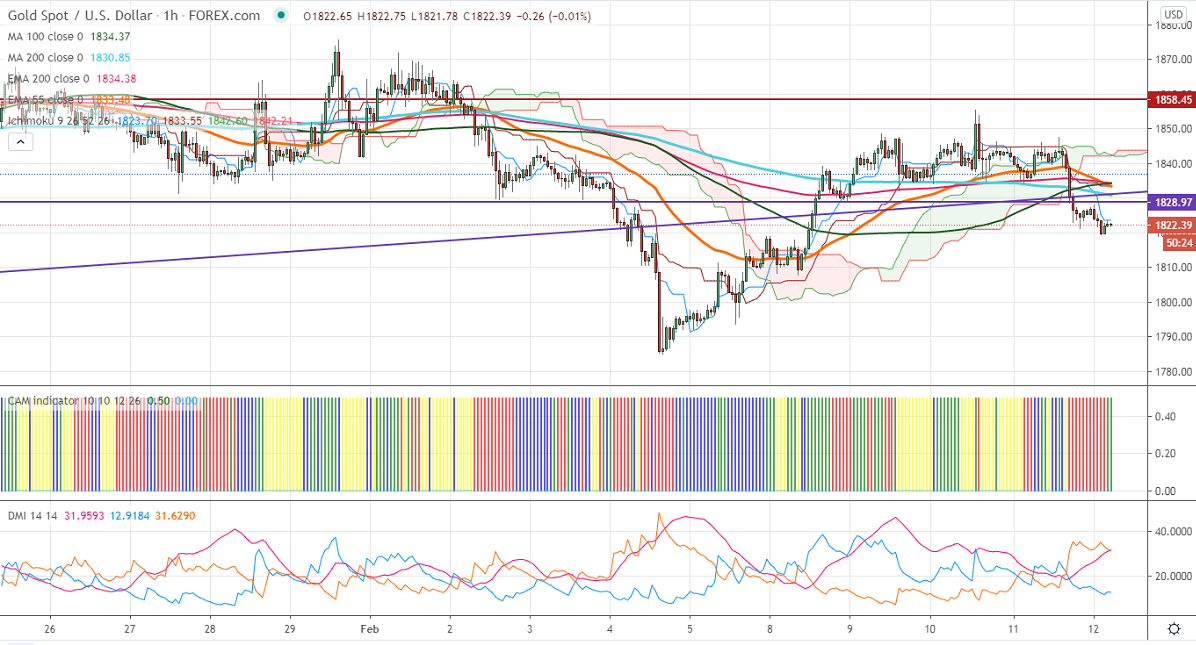

Ichimoku analysis (Hourly Chart)

Tenken-Sen- $1823.70

Kijun-Sen- $ 1833.55

Gold continues to trade weak despite the weak US dollar. The yellow metal declined due to strong global stock markets on upbeat market sentiment. The progress in US stimulus, coronavirus vaccine rollout is also putting pressure on the gold at higher levels. Markets eye Sino-US trade talks which are set to happen after Chinese New year. The short term trend is still neutral as long as resistance $1860 holds. US dollar index continues to trade lower for fourth consecutive days; violation below 91 confirms further weakness.

Economic data:

The number of people who have filed for unemployment benefits rose to 793000 compared to a forecast of 76000. Continuing claims benefits declined by 145000 to 4.54 million.

Technical:

The yellow metal is facing strong resistance at $1860. Any violation above that level confirms minor bullishness, a jump till $1875 likely.

On the lower side, near term support is around $1820, any indicative break below that level will take till $1820/$1800/$1780.

It is good to sell on rallies around $1829-30 with SL around $1840 for the TP of $1800.