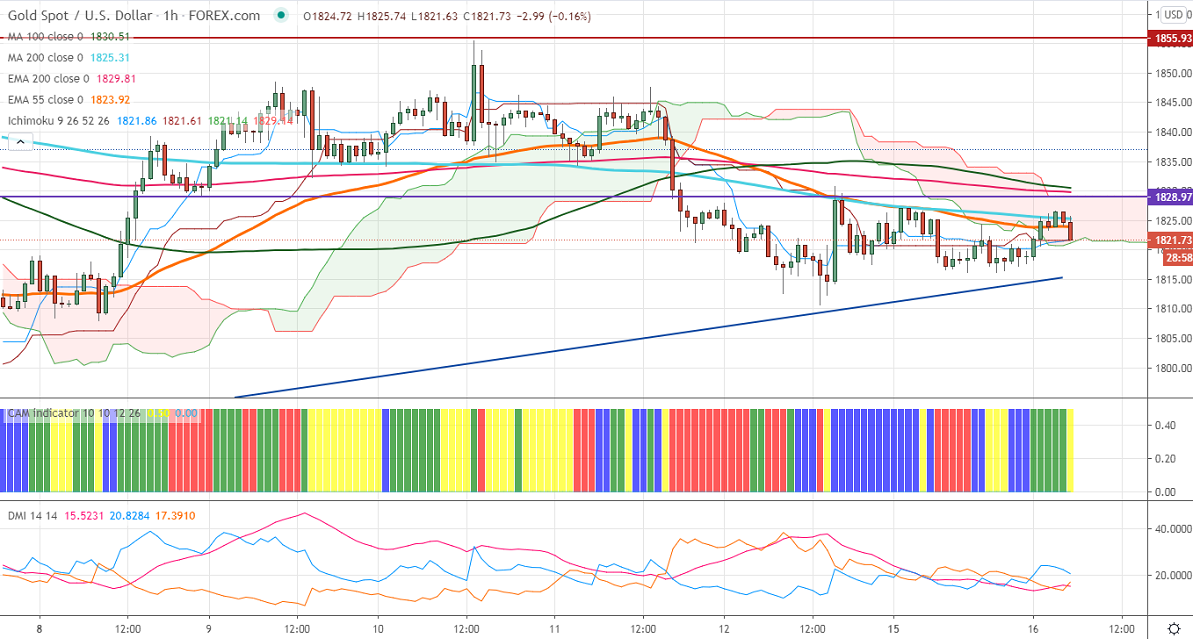

Ichimoku analysis (Hourly Chart)

Tenken-Sen- $1821.49

Kijun-Sen- $ 1821.61

Gold has taken support near trend line support and shown a minor recovery. The record rally in the US market especially in S&P500 on upbeat market sentiment is putting pressure on the yellow metal. The US 10-year yield surged sharply and hits the highest level since Mar on positive US cues. The short term trend is still neutral as long as resistance $1860 holds. US dollar index continues to trade lower after a minor jump till 90.74; violation below 90 confirms further weakness.

Technical:

The yellow metal is trading slightly above Tenken-Sen and Kijun-Sen. It is facing strong resistance at $1830 (2300-H EMA). Any violation above that level confirms minor bullishness, a jump till $1860 likely.

On the lower side, near term support is around $1816, any indicative break below that level will take till $1800/$1780.

It is good to buy on dips around $1810-11 with SL around $1800 for the TP of $1860.