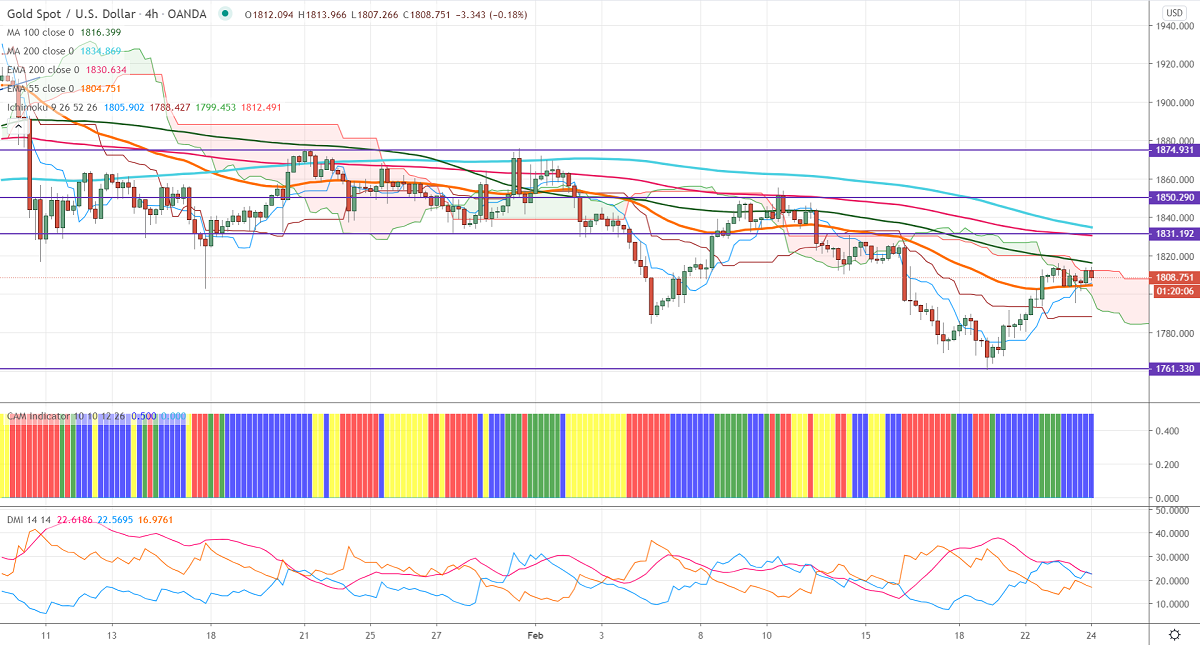

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1808

Kijun-Sen- $1805

Gold is consolidating after a minor jump to $1816. The US dollar index declined slightly after a dovish comment from Fed chairman Powell. In the semi-annual testimony, Powell stated that the decline in the number of coronavirus cases and hospitalization and ongoing vaccinations has increased hopes of the normal condition later this year. The yield has lost more than 5% after hitting a multi-year high. The index of consumer confidence rose to a 3-month high at 91.3 in Feb better than the forecast of 90.

Technical:

The yellow metal is facing significant support at $1790, any violation below will drag the commodity to $1760/$1750.The significant nearby resistance is $1816, any indicative break above will take the gold till $1829/$1837/$1850.

It is good to buy on dips around $1785-88 with SL around $1760 for the TP of $1860.