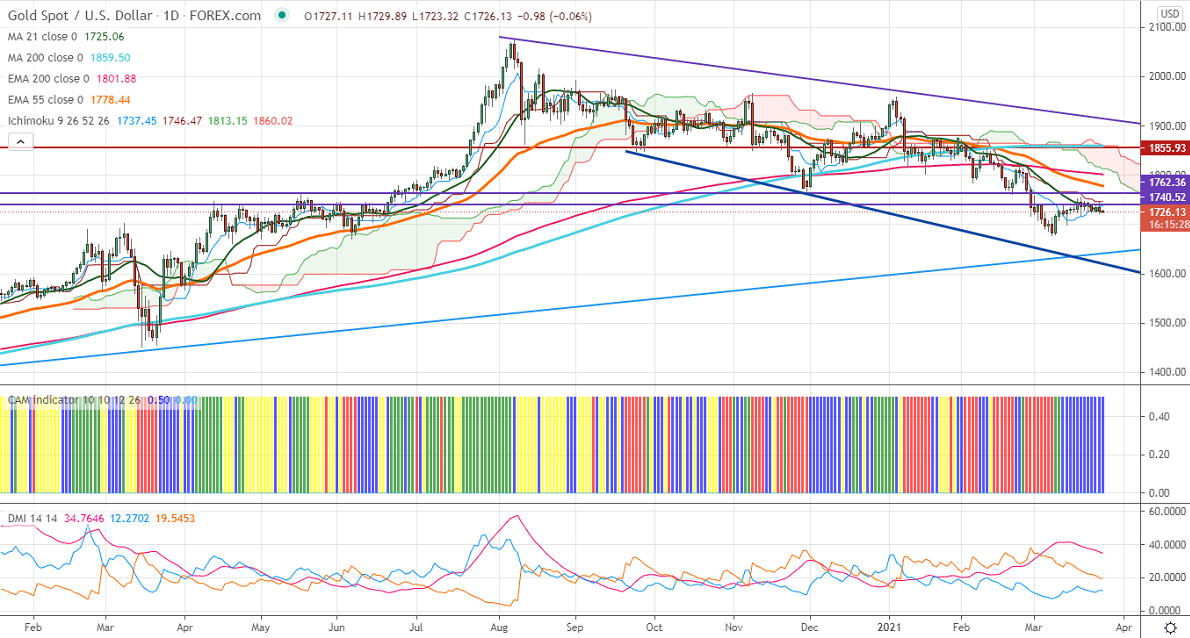

Ichimoku analysis (1-hour chart)

Tenken-Sen- $1727

Kijun-Sen- $1733

Gold has once again declined after a minor jump to the $1745 level. The huge buying in US dollar is putting pressure on yellow metal at higher levels. DXY is holding above 200-day EMA, a jump till 93.25/93.60 is possible. The slight selling pressure in US bond yield is supporting the gold at lower levels.

Economic data:

US real GDP expanded at an annualized rate of 4.3% in Q4 vs a forecast of 4.1%. The number of people who have filed for unemployment has fallen to 684000 last week compared to a forecast of 727000. Market eyes US PCE, personal income, and spending for further direction.

Technical:

It is facing strong support at $1719, violation below targets $1700/$1685. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1783.

It is good to sell on rallies around $1740-41 with SL around $1760 for the TP of $1685.