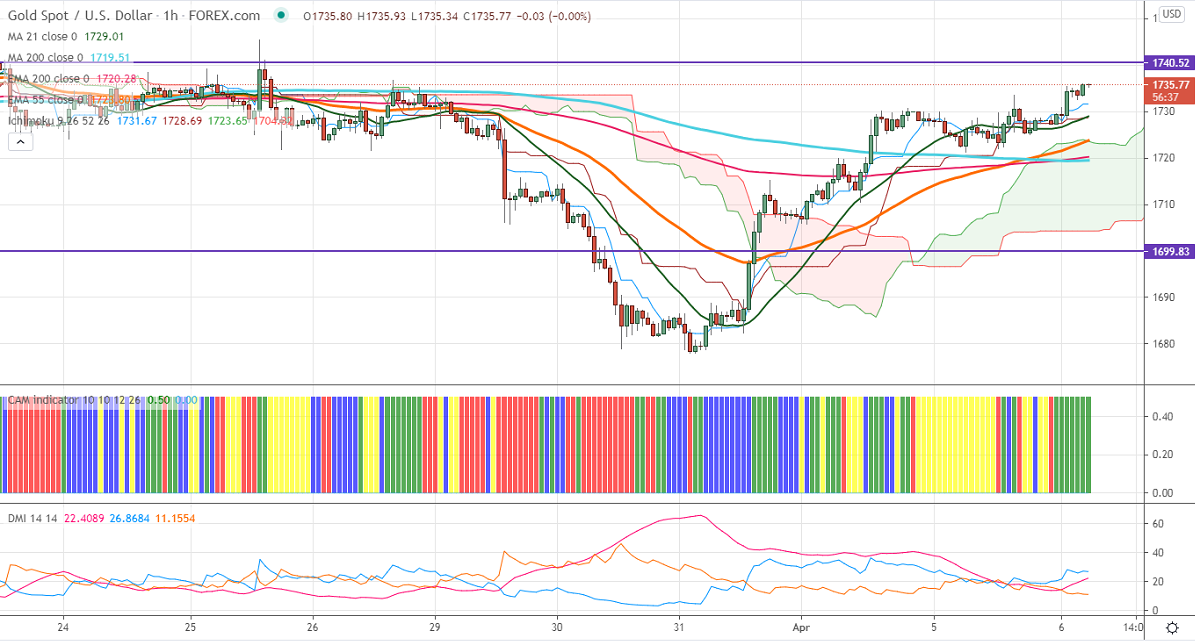

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1731.67

Kijun-Sen- $1728

Gold is trading higher and holding well above $1700 on dollar weakness. The US dollar index has lost more than 90 pips for a high of 93.43. The minor profit booking in US bond yield is also supporting the yellow metal. US 10-year yield declined more than 3% from yesterday's high 1.745%.

Economic data:

US ISM services surged to a record high in Mar due to upbeat growth in new orders. It came at 63.7comapred to a forecast of 58.3.

Technical:

It is facing strong support at $1725, violation below targets $1719/$1700. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1745, any indicative break above that level will take till $1760/$1783.

It is good to sell on rallies around $1744-45 with SL around $1760 for the TP of $1675.