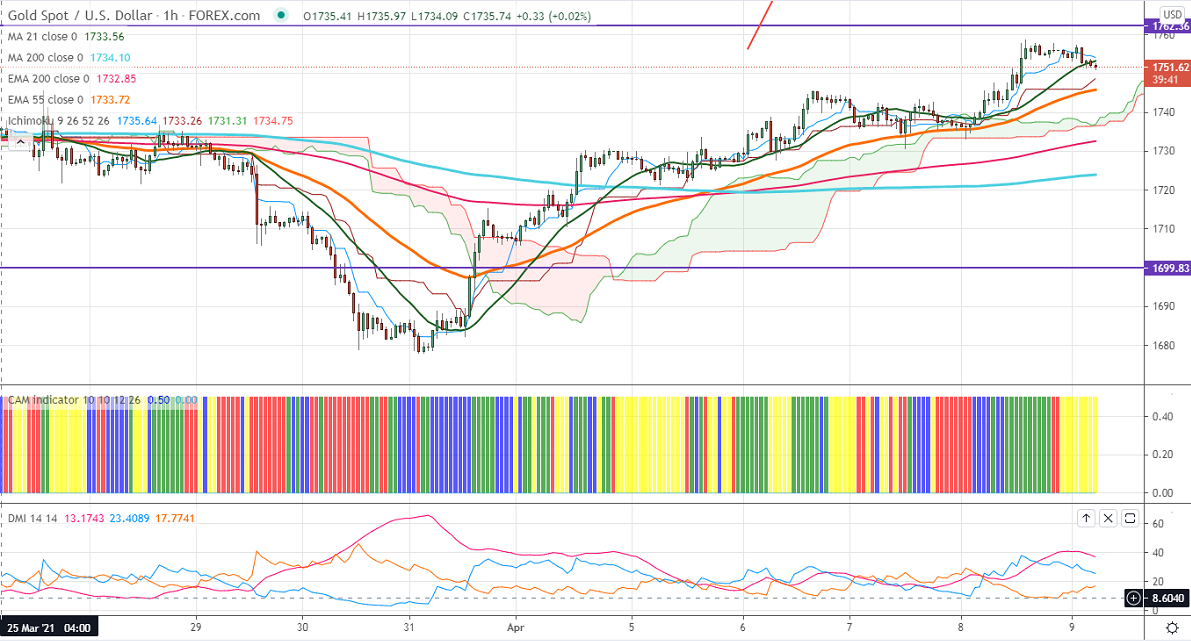

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1754

Kijun-Sen- $1747

Gold recovered sharply more than $20 on broad-based US dollar weakness. The slight sell-off in US bond yield after dovish FOMC minutes also supporting the yellow metal at a lower level. The US 01- year bond yield lost more than 9% from minor top 1.774%. DXY is trading weak and significant bearish continuation only if it breaks 91.80.

Economic data:

The number of people filed for unemployment benefits rose 744K last week compared to a forecast of 682K.

Technical:

It is facing strong support at $1745 (resistance turned into support), violation below targets $1730/$1723. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1760, any indicative break above that level will take till $1783/$1800.

It is good to buy on dips $1745 with SL around $1730 for the TP of $1780.