Ichimoku analysis (Hourly chart)

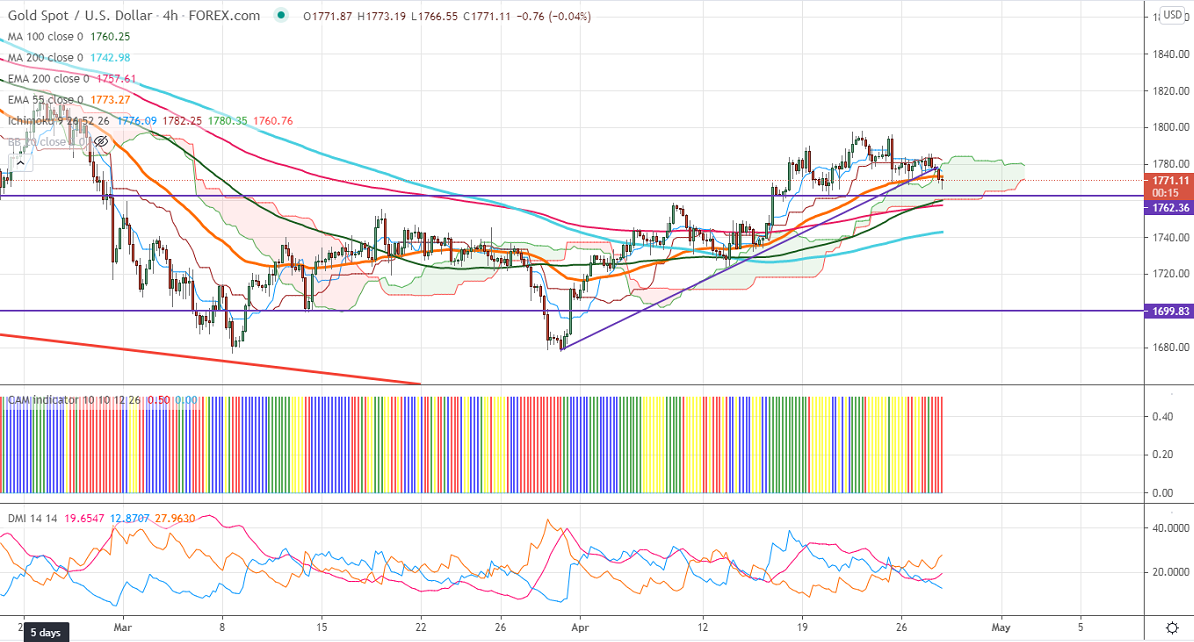

Tenken-Sen- $1777

Kijun-Sen- $1783

Gold is trading slightly lower on strong US bond yield. The US 10-year yield surged more than 6.5% from a minor bottom 1.53%. Markets eyes US fed FOMC statement today for further direction. The central bank is expected to keep rates and bond purchases unchanged. The US dollar index is struggling to close above 100-H MA. Any bullishness only if it breaks 91.25. The yellow metal hits an intraday low of $1766 and is currently trading around $1771.69.

Technical:

It is facing strong support at $1759.77 (100-4H MA), violation below targets $1752.71/$1740 (200-4H MA). Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1782, any indicative break above that level will take till $1792/$1802/$1821.

It is good to buy on dips around $1773 with SL around $1760 for the TP of $1802/$1820.