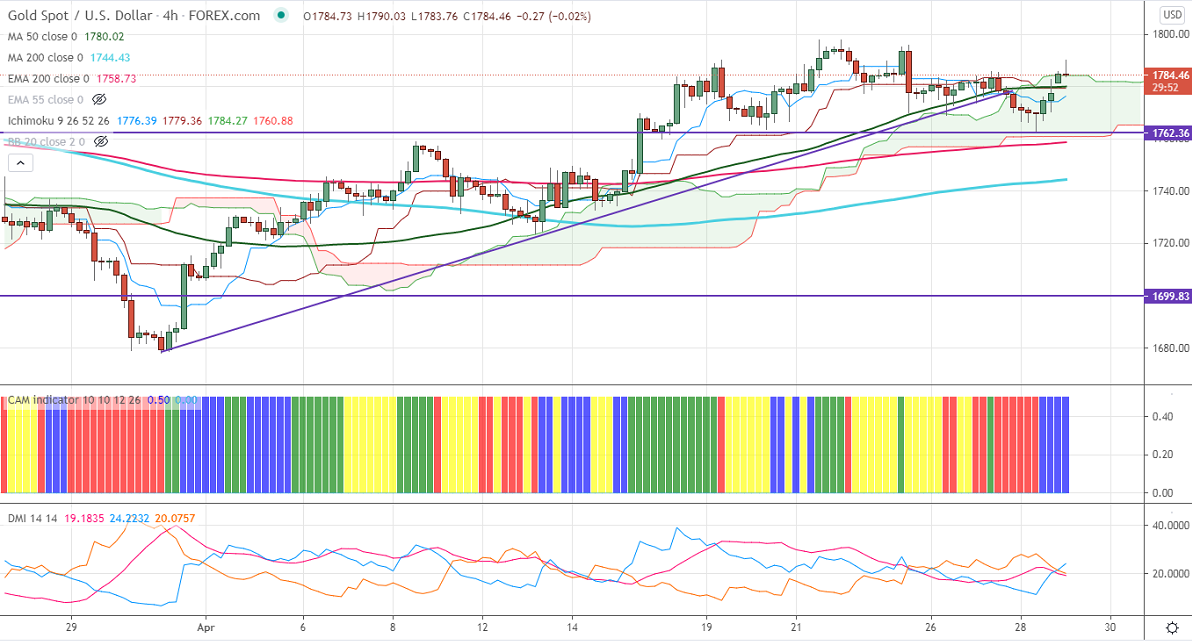

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1774

Kijun-Sen- $1779

Gold jumped more than $10 after Fed monetary policy meeting. The central bank has kept its rates unchanged and left its $120bn bond-buying programs. They have said that vaccine rollout has strengthened economic activity and employment. The US 10-year yield lost more than 3% from a high of 1.659%. The US dollar index is trading well below 91 levels and any break below 90.60 confirms further weakness. The yellow metal hits an intraday high of $1790 and is currently trading around $1784.24.

Technical:

It is facing strong support at $1758 (100-4H MA), violation below targets $1752.71/$1740 (200-4H MA). Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1802 any indicative break above that level will take till $1821/$1835.

It is good to buy on dips around $1773 with SL around $1760 for the TP of $1802/$1820.