FxWirePro- Gold Daily Outlook

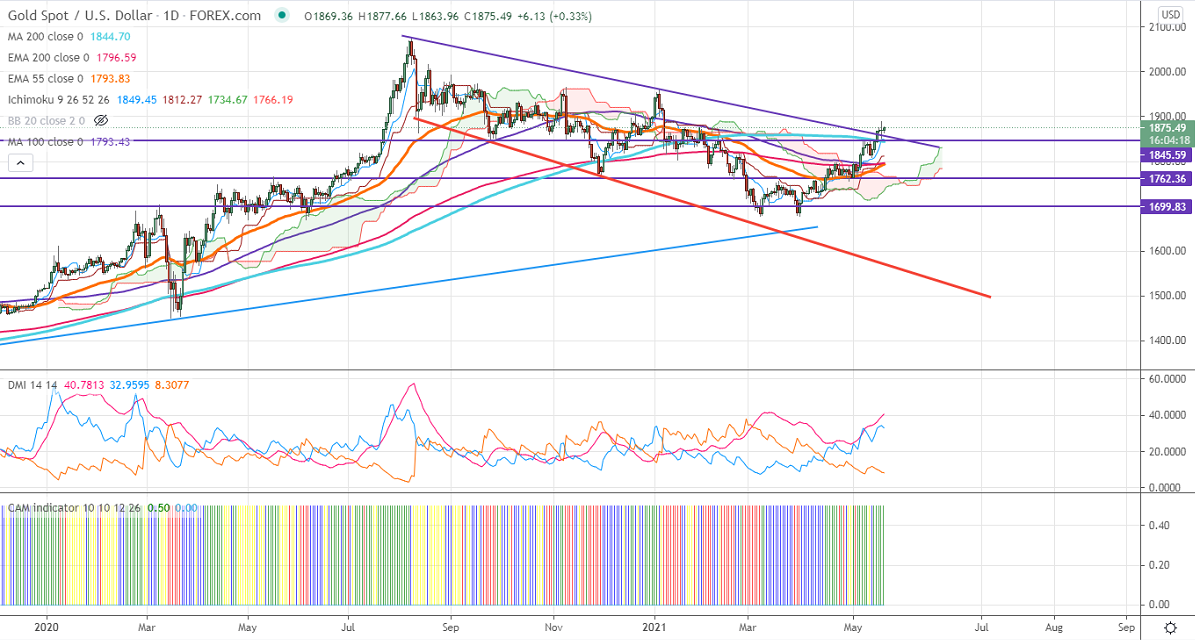

Ichimoku analysis (Daily chart)

Tenken-Sen- $1849

Kijun-Sen- $1811

Gold declined nearly $30 post FOMC minutes. The minutes for the FOMC meeting in Apr showed that some of the members are slightly hawkish and discussed QE tapering. "A number of participants suggested that if the economy continued to make rapid progress toward the Committee's goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases," the minutes said. The dollar index jumped more than 50 pips from the minor bottom 89.69. The yellow metal hits an intraday high of $1877 and is currently trading around $1875.42.

Technical:

It is facing strong support at $1860, violation below targets $1850/$1845/$1838. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1890, any convincing break above confirms bullish continuation. A jump to $1900/$1932/$1959 is possible.

It is good to buy on dips around $1861-62 with SL around $1850 for the TP of $1898.