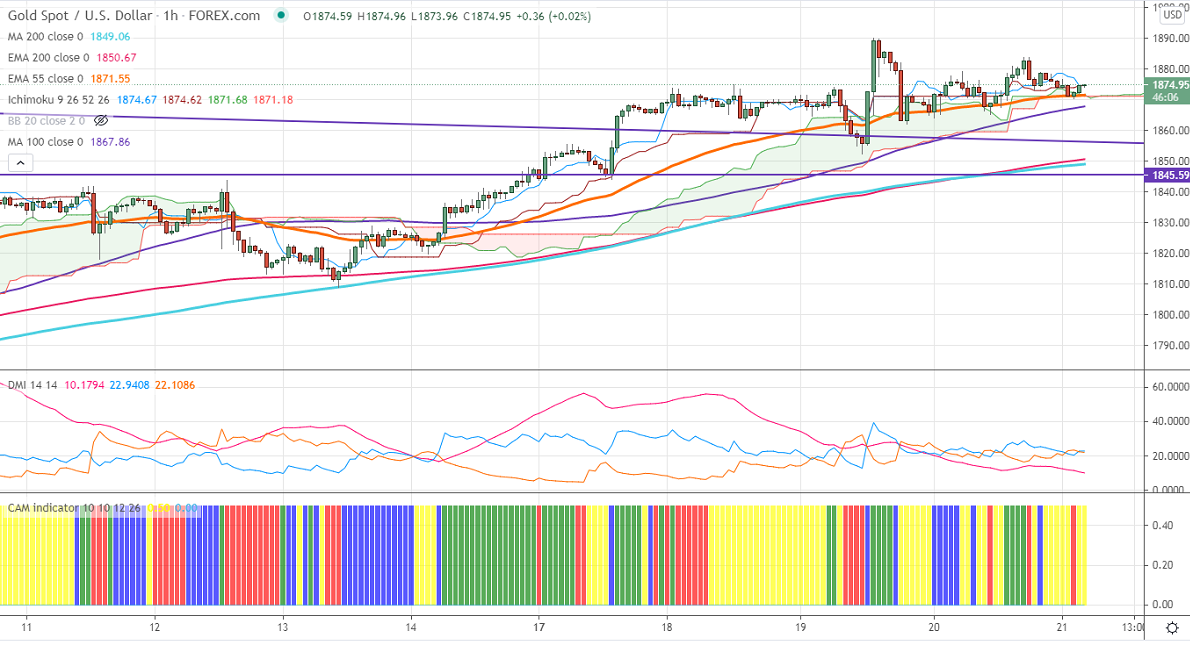

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1874.67

Kijun-Sen- $1874.62

Gold is consolidating in a narrow range between $1862and $1890 for the past two days. The weak US dollar and US bond yields unable to push gold prices higher. The slightly hawkish tone by Fed on tapering of bond purchase is putting pressure on the yellow metal. The number of people who have filed for unemployment benefits declined to 444000 the previous week compared to a forecast of 453K. The Philadelphia Federal reserve business activity fell to 31.5 in May from 50.2 in Apr. The dollar index is holding below 90 levels, a dip to 89.20 is possible. The yellow metal hits an intraday high of $1878.50 and is currently trading around $1874.70.

Technical:

It is facing strong support at $1860, violation below targets $1850/$1845/$1838. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1890, any convincing break above confirms bullish continuation. A jump to $1900/$1932/$1959 is possible.

It is good to buy on dips around $1861-62 with SL around $1850 for the TP of $1898.