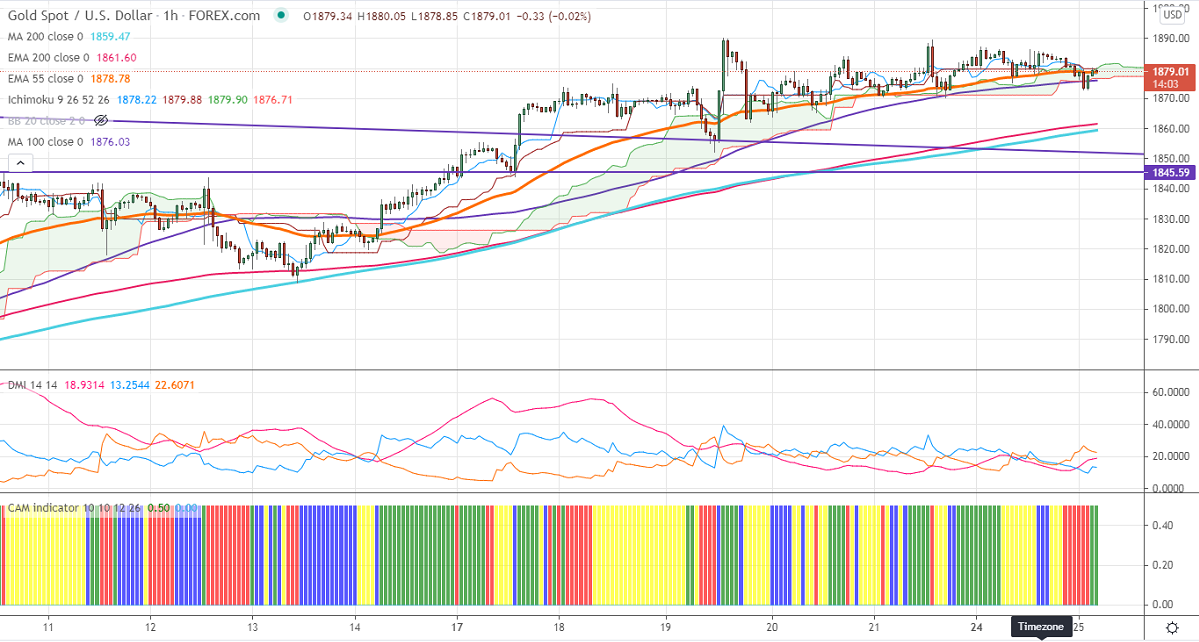

Ichimoku analysis (Hourly chart)

Tenken-Sen- $1878

Kijun-Sen- $1879

Gold is consolidating in a narrow range between $1862 and $1890 for the past four days. The minor weakness in the US dollar is supporting the yellow metal at lower levels. The rise in inflation is preventing gold from further upside. The US 10- year bond yield lost more than 5.80% from a minor top of 1.692%. The yellow metal hits an intraday high of $1878.50 and is currently trading around $1874.70. Markets eye US Conference Board consumer confidence and new home sales for further direction.

Technical:

It is facing strong support at $1860, violation below targets $1850/$1845/$1838. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1890, any convincing break above confirms bullish continuation. A jump to $1900/$1932/$1959 is possible.

It is good to buy on dips around $1861-62 with SL around $1850 for the TP of $1898.