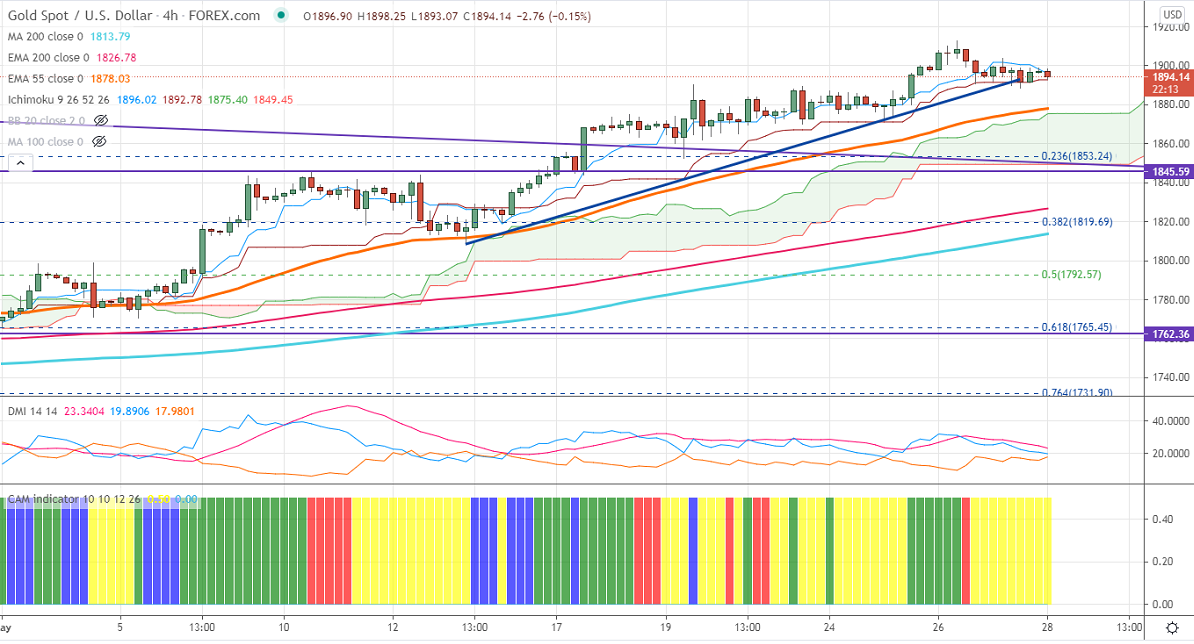

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1898.50

Kijun-Sen- $1892

Gold is consolidating after hitting a multi-month high of $1912.80. DXY recovered from a low of 89.53 and holding above 90 levels. Any jump above 90.30 confirms a bullish continuation. The Biden is expected to propose a $6 trillion budget that will boost education, infrastructure, and healthcare The US first-quarter GDP came unchanged at 6.4% slightly less than the forecast of 6.5%. US Durable goods orders declined by 1.3% weaker than the estimated 0.8%. The number of people who have filed for unemployment benefits dropped to 406000 last week. The US 10-year bond yield surged more than 2% from the recent low of 1.552%. The yellow metal hits an intraday high of $1898.65 and is currently trading around $1894.19.

Technical:

It is facing strong support at $1890, violation below targets $1875/$1860/$1850. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1920, any convincing break above confirms bullish continuation. A jump to $1932/$1959 is possible.

It is good to buy on dips around $1878-80 with SL around $1860 for the TP of $1932.