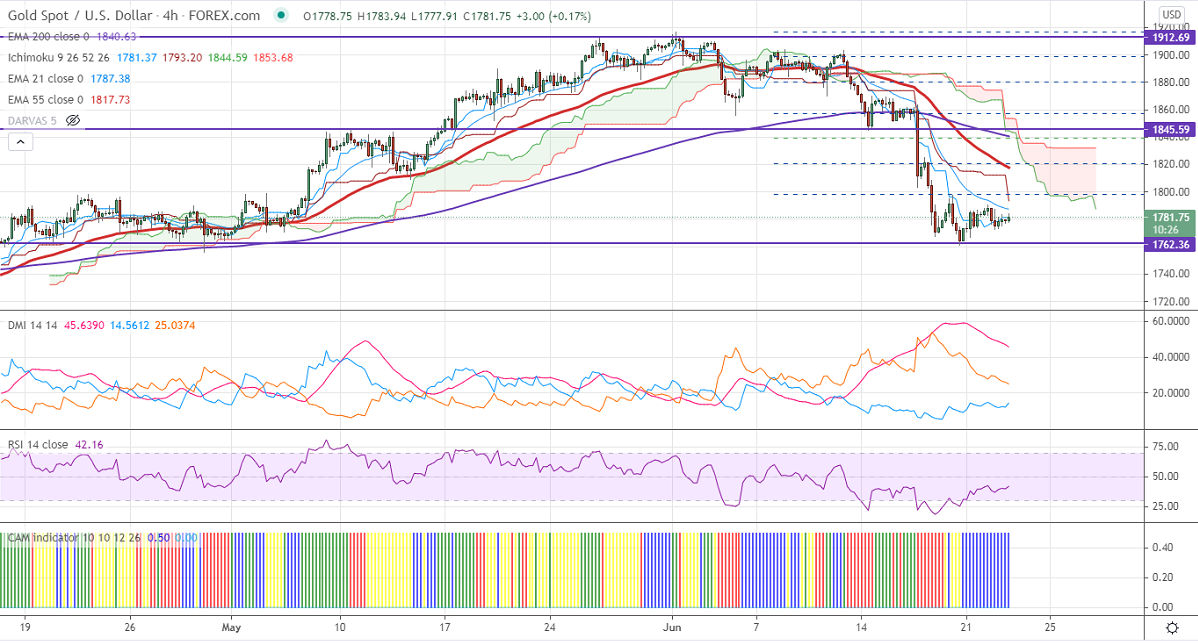

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1781

Kijun-Sen- $1812

Gold recovered slightly after a major sell-off to $1764. The yellow metal was one of the worst performers and the previous week on strong US dollar. The overall trend is weak as long as resistance $1916 holds. The US dollar index is struggling to close above 92 levels. Any breach above 92.50 confirms a bullish continuation. The slight pullback of more than 10% in US 10-year bond yield is putting pressure on the yellow metal. Gold hits an intraday high of $1782 and is currently trading around $1781. Markets eye flash manufacturing PMI data for further direction.

Fed chairman said that the surge in inflation was mainly due to the reopening of the economy after the pandemic.

Technical:

It is facing strong support at $1760, violation below targets $1740/$1720/$1700.Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal to $1825/$1835/$1860 is possible. It is holding well below 200- day EMA for the past three days.

It is good to sell on rallies around $1800-01 with SL around $1825 for the TP of $1700.