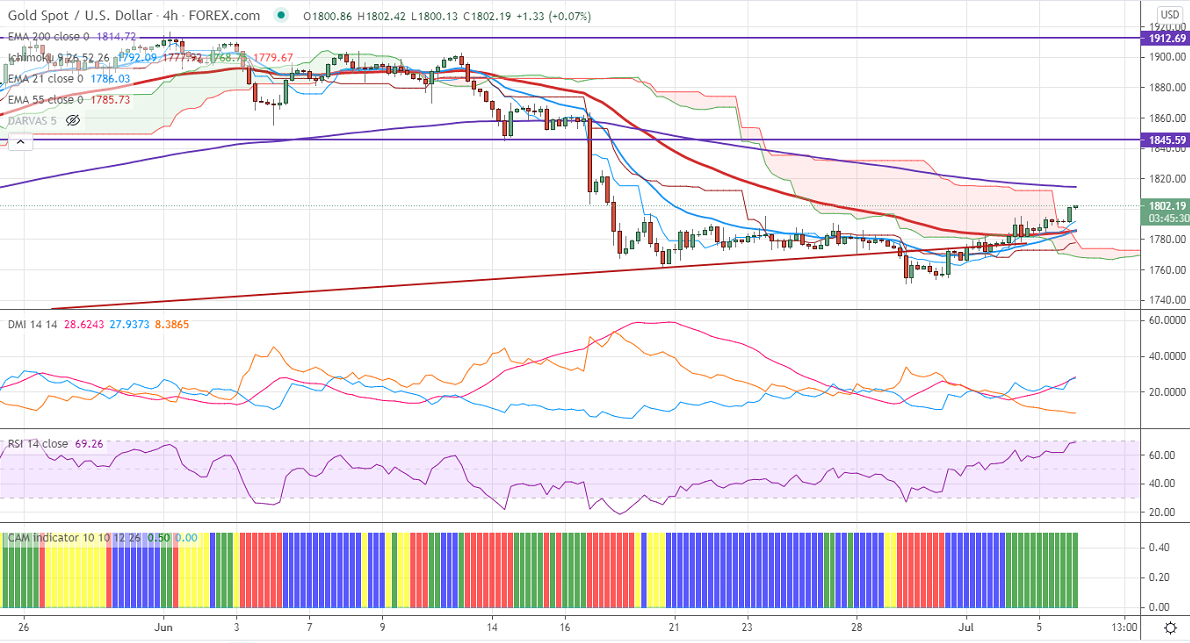

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1785

Kijun-Sen- $1773

Gold recovered sharply more than $50 and hits a 3-week high on the softer dollar. Markets eye US ISM services data for further direction. DXY continues to trade weak for the past three days and holding above 92. Any breach below 92 confirms intraday weakness. The US 10- year yield rose by two basis points from the previous week's low of 1.4270. It hits an intraday high of $1799.99 and is currently trading around $1799.24.

Technical:

It is facing strong support at $1785, violation below targets $1773/$1768/$1753. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1800, any convincing break above will take the yellow metal to $1815/$1836/$1860 is possible.

It is good to sell on rallies around $1800-01 with SL around $1825 for the TP of $1700.