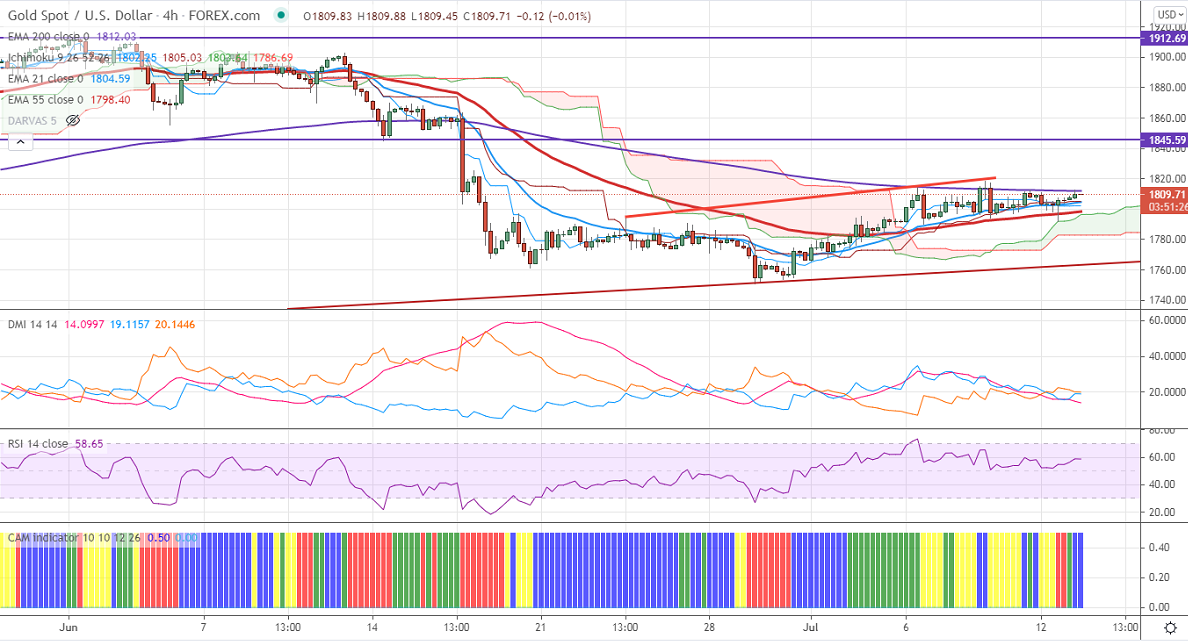

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1802.25

Kijun-Sen- $1805.20

Gold is trading in a narrow range between $1818 and $1791 for the past four days. The minor weakness in the US dollar is preventing the yellow metal from further sell-off. The rebound in the US 10-year yield is putting pressure at higher levels. It hits an intraday high of $1812.75 and is currently trading around $1809.78. Markets eye US CPI data for further direction.

Technical:

It is facing strong support at $1790, violation below targets $1784/$1776/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1815, any convincing break above will take the yellow metal to $1836/$1860 is possible.

It is good to buy on dips around $1790-91 with SL around $1772 for the TP of $1836.