Ichimoku analysis (4-hour chart)

Tenken-Sen- $1809.24

Kijun-Sen- $1826.92

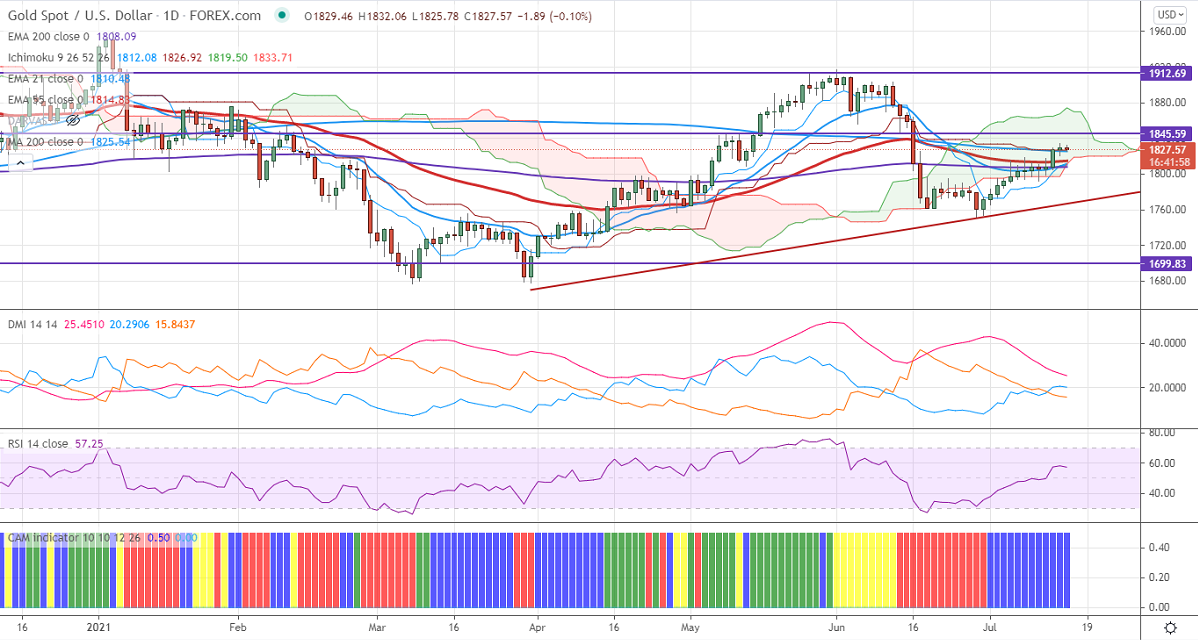

Gold continues to trade higher for the tenth consecutive day and holding well above $1800 despite the strong US dollar. The hawkish comments from the US Fed chairman and decline in US bond yields are supporting the yellow metal at lower levels. It hits an intraday high of $1832.06 and is currently trading around $1827.45.

Economic data-

US weekly jobless claims came at 360k vs. 350k expected. The Philly Fed manufacturing index declined to 21.9 compared to an estimate of 28.

Technical:

It is facing strong support at $1790, violation below targets $1784/$1776/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1826 (200- day MA), any daily close above will take the yellow metal to $1836/$1860 is possible.

It is good to buy on dips for around $1815 with SL around $1800 for the TP of $1860.