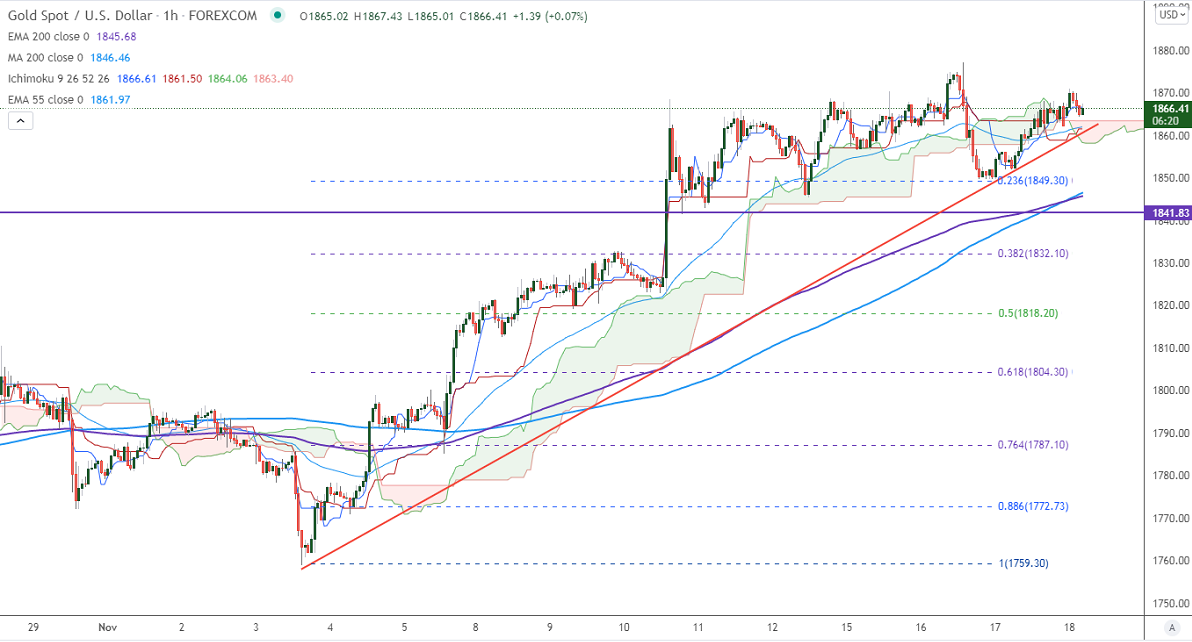

Ichimoku analysis (1 Hour chart)

Tenken-Sen- $1866.61

Kijun-Sen- $1861.50

Gold is trading strong despite US dollar strength. The overall weakness in global equities is supporting the yellow metal. The US dollar index has declined after a rally to 96.24. A decline to 95.40 is possible. Markets eye US Philly Fed manufacturing index and US jobless claims for further direction. Gold hits a low of $1869.99 and is currently trading around $1867.21.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

It faces strong support at $1849, violation below targets $1840/$1820/$1798/$1780. Significant trend continuation only below $1675. The yellow metal facing strong resistance $1875, any breach above will take to the next level $1900/1915 is possible.

It is good to sell on rallies around $1870 with SL around $1880 for TP of $1800.