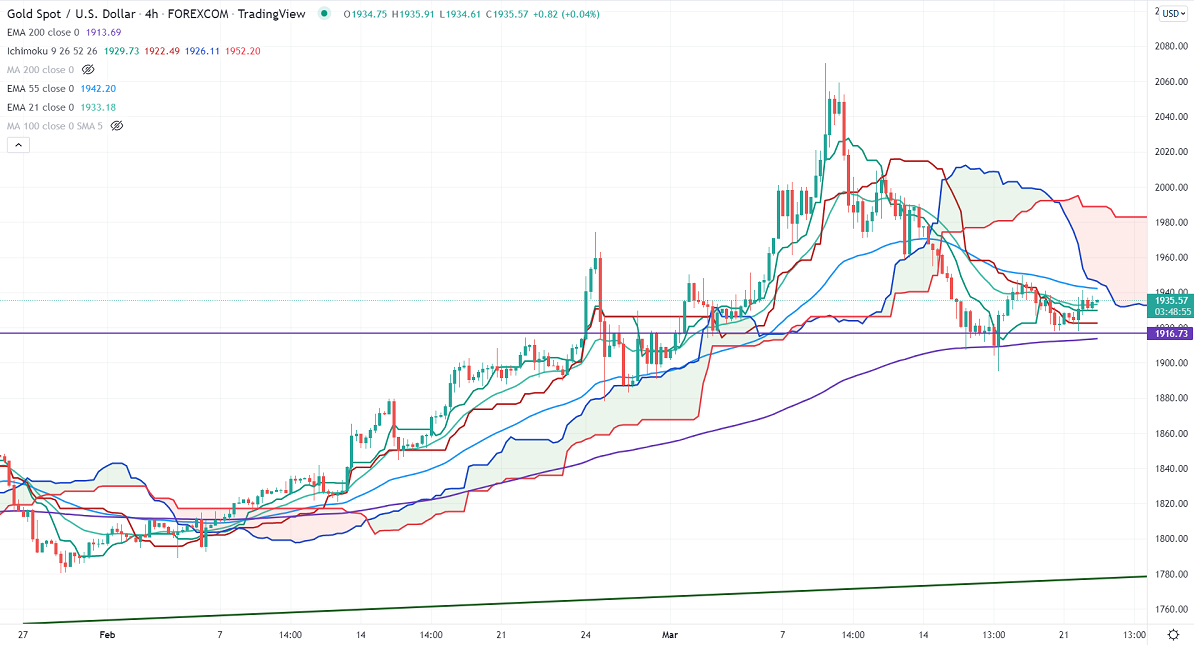

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1929.70

Kijun-Sen- $1922.40

Gold gained above $1930 on an escalation of conflict between Russia and Ukraine. The demand for safe-haven assets supports the yellow metal at lower levels. The US 10-year yield hits fresh year high as Powell warns about inflation. Gold jumped to $1941.57 yesterday and is currently trading around $1935.37.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1918, violation below targets $1895/$1877/$1850/$1800. Significant reversal only below $1750.The yellow metal faces strong resistance of $1950, any violation above will take to the next level $1960/$1977/$2000/$2020.

It is good to buy on dips around $1920-21 with SL around $1895 for TP of $2000.