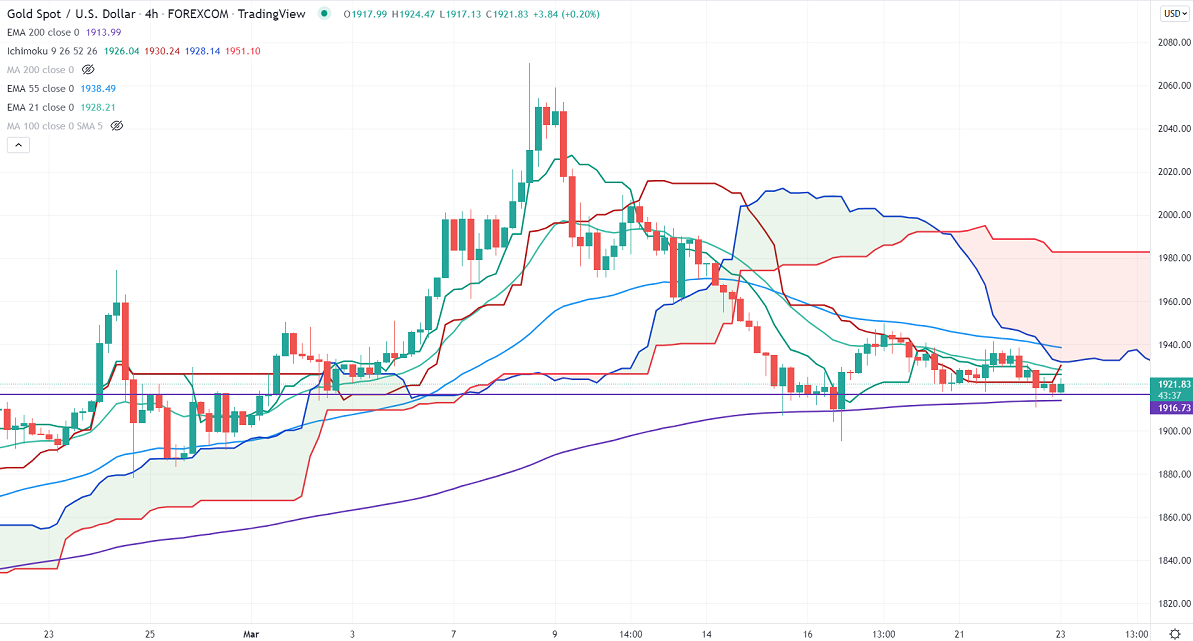

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1926.04

Kijun-Sen- $1922.49

Gold drifts lower on hawkish comments from Fed Chairman Powell. But Russia and Ukraine conflict prevented the yellow metal from further sell-off. The US 10-year yield hits the highest level since Jul 2019 on aggressive Fed tightening. Gold jumped to $1924.45 at the time of writing. It is currently trading around $1921.97.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1910, violation below targets $1895/$1877/$1850/$1800. Significant reversal only below $1750.The yellow metal faces strong resistance of $1950, any violation above will take to the next level $1960/$1977/$2000/$2020.

It is good to buy on dips around $1920-21 with SL around $1895 for TP of $2000.