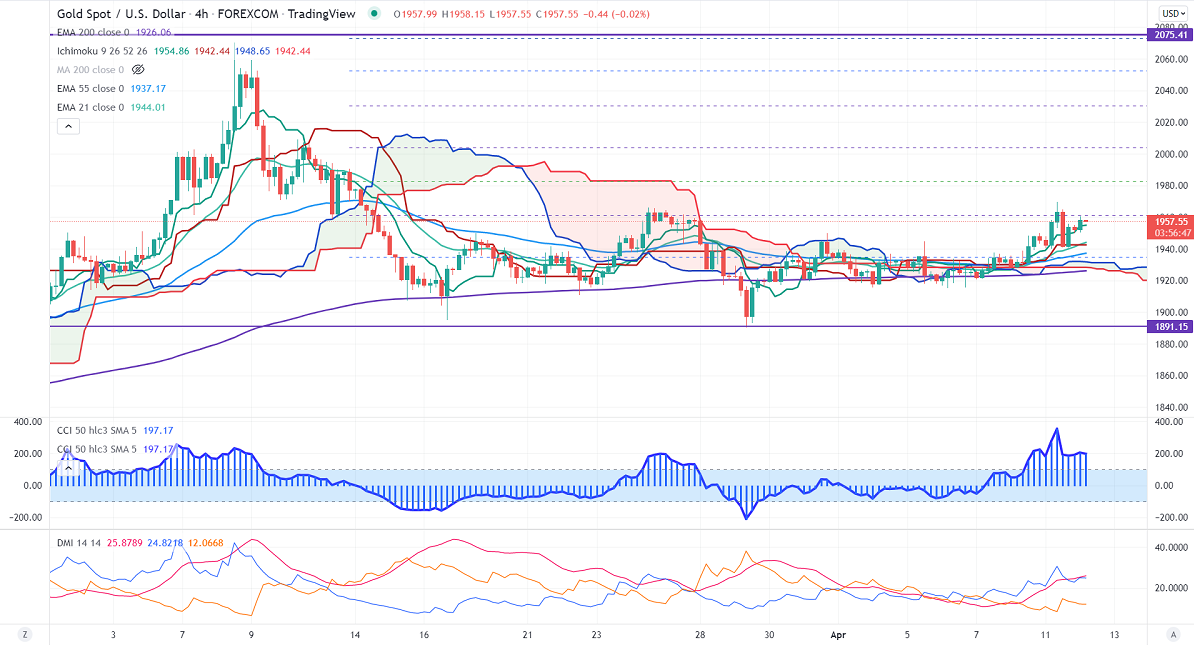

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1954.26

Kijun-Sen- $1942.44

Gold breaks significant resistance at $1950 after long consolidation despite a surge in US bond yields. US dollar index regained above 100 levels ahead of US CPI data. Any daily close above 100 confirms further bullishness. US 10-year yield jumped sharply and hits the highest level in three years in hopes of an aggressive rate hike by the Fed. The yellow metal hits a high of $1969.66 and is currently trading around $1959.64.

Factors to watch for gold price action-

Global stock market- weak (Positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1940 (yesterday's low), breach below confirms the intraday bearish trend. A dip to $1925/$1910/$1900/$1890. Significant reversal only below $1890. The yellow metal faces strong resistance of $1961 (38.2% fib), any breach above will take to the next level $1982/$2000/$2020.

It is good to sell on rallies around $1960-61 with SL around $1975 for TP of $1850.