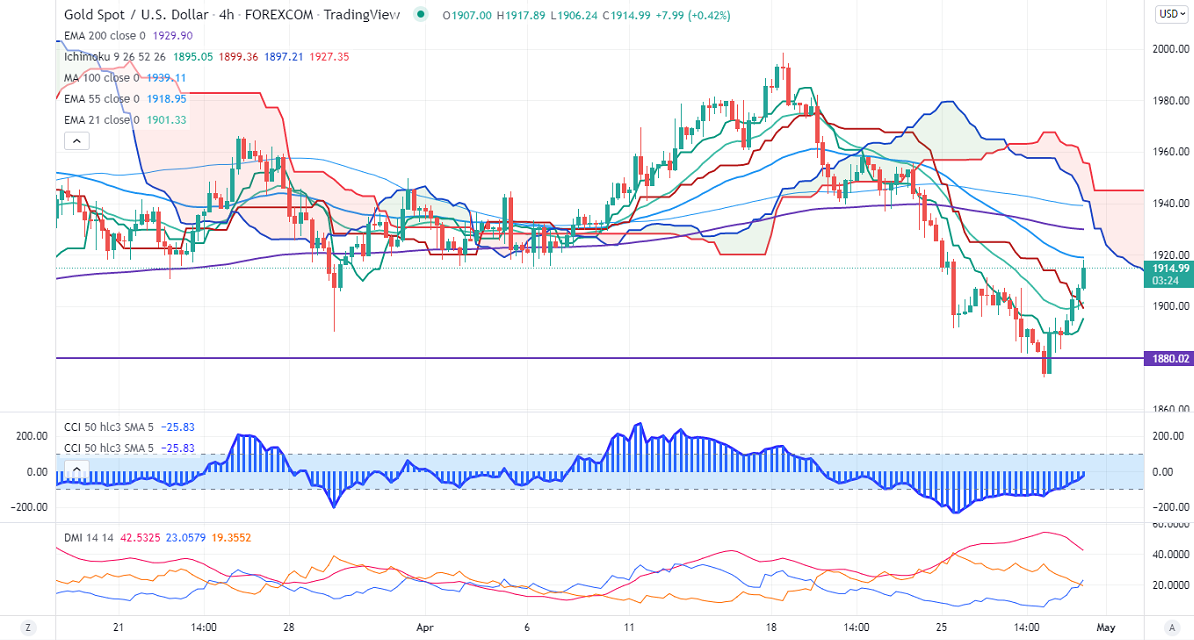

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1913

Kijun-Sen- $1903.33

Gold regained above $1915 amid US dollar weakness. US dollar index halted its six days of the bullish trend and showed a minor profit booking. The yellow metal struggling in the near term due to Fed monetary policy. According to the Fed watch tool, the probability for a 50 bpbs rate hike in May has increased to 98.7% from 97.1% a day ago. It hits an intraday high of $1917 and is currently trading around $1916.15.

Markets eye US PCE data for further direction.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bearish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1890, a breach below targets $1870/$1850. Significant reversal only below $1750.The yellow metal faces strong resistance of $1920, any breach above will take to the next level $1932/$1950/$1970.

It is good to sell on rallies around $1958-60 with SL around $2000 for TP of $1800.