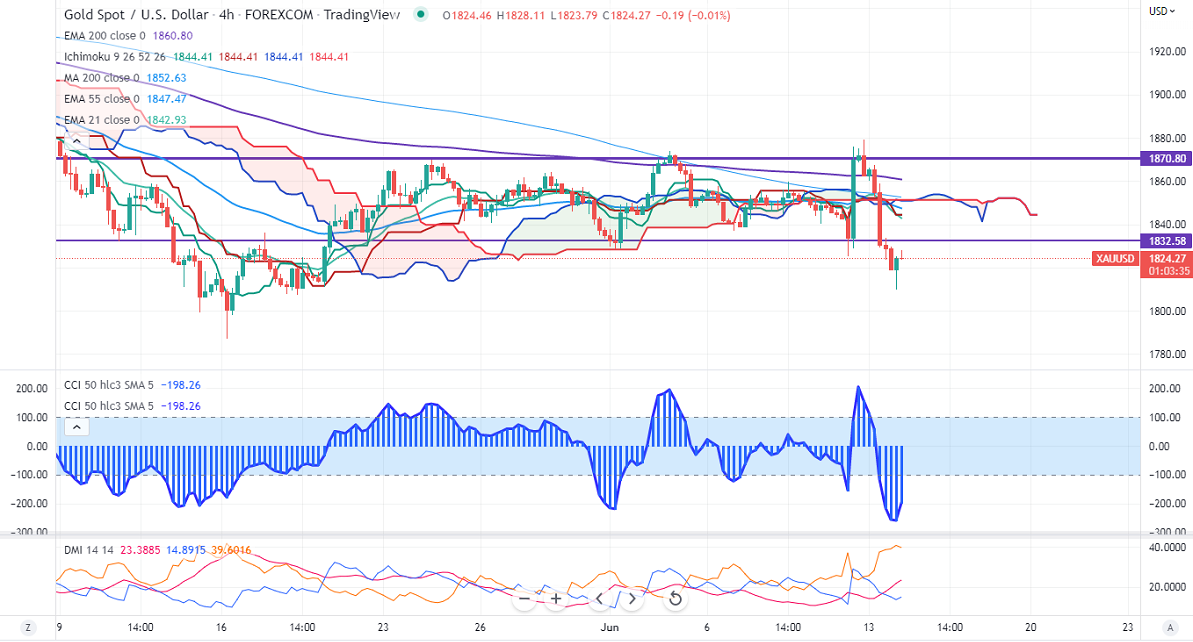

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1844.41

Kijun-Sen- $1844.41

Gold price fell drastically on board-based US dollar buying. The jump in US CPI has increased hopes of aggressive rate hikes by the Fed. Markets eye US Fed monetary policy tomorrow for further direction. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Jun increased to 95.3% from 3.1 % a week ago. It hits a low of $1808 and is currently trading around $1824.95.

Any 75bpbs rate hike by Fed tomorrow will drag the yellow metal down to $1750.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1800, a breach below targets $1780/$1750. Significant reversal only below $1750. A dip to $1700/$1689 is possible. The yellow metal faces strong resistance of $1837, any breach above will take it to the next level of $1850/$1900/$1920.

It is good to buy on dips around $1810 with SL around $1785 for TP of $1880.