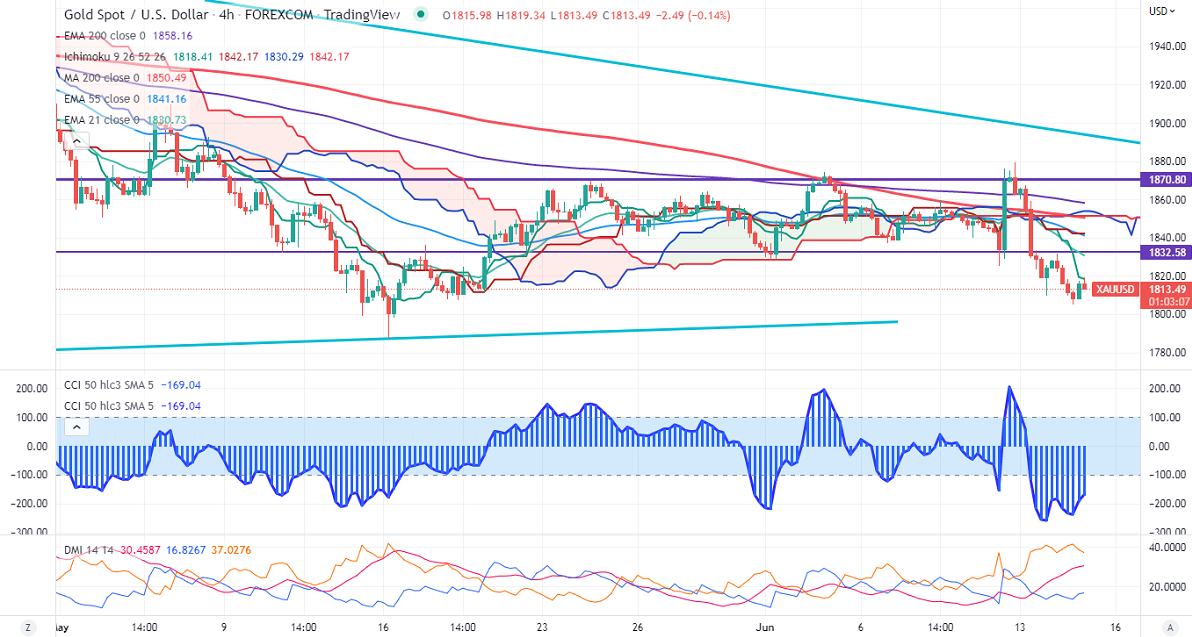

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1819.41

Kijun-Sen- $1842.17

Gold fell drastically and lost more than $70 ahead of US fed policy. US Yearly inflation dropped to 10.8% compared to a forecast of 10.9%.y the Fed. Markets eye US Fed monetary policy tomorrow for further direction. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Jun increased to 96.5% from 3.9 % a week ago. It hits a low of $1805 and is currently trading around $1814.63.

Factors to watch for gold price action:

Global stock market- Bearish (Positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1800, a breach below targets $1780/$1750. Significant reversal only below $1750. A dip to $1700/$1689 is possible. The yellow metal faces strong resistance of $1837, any breach above will take it to the next level of $1850/$1900/$1920.

It is good to sell on rallies around $1828-30 with SL around $1851 for TP of $1750.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Why the Middle East is being left behind by global climate finance plans

Why the Middle East is being left behind by global climate finance plans  South Korea to End Short-Selling Ban as Financial Market Uncertainty Persists

South Korea to End Short-Selling Ban as Financial Market Uncertainty Persists  U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors

U.S. Condemns China's Dominance in Global Shipbuilding and Maritime Sectors  S&P 500 Surges Ahead of Trump Inauguration as Markets Rally

S&P 500 Surges Ahead of Trump Inauguration as Markets Rally  Infosys Shares Drop Amid Earnings Quality Concerns

Infosys Shares Drop Amid Earnings Quality Concerns  KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards

KiwiSaver shakeup: private asset investment has risks that could outweigh the rewards  Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’

Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’  Gold Prices Rise as Markets Await Trump’s Policy Announcements

Gold Prices Rise as Markets Await Trump’s Policy Announcements  Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation

Ferrari Group to Launch IPO in Amsterdam, Targets Over $1 Billion Valuation  Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth

Elliott Investment Management Takes Significant Stake in BP to Push for Value Growth  Why your retirement fund might soon include cryptocurrency

Why your retirement fund might soon include cryptocurrency  Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure

Tempus AI Stock Soars 18% After Pelosi's Investment Disclosure  Investors value green labels — but not always for the right reasons

Investors value green labels — but not always for the right reasons  Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies

Bitcoin Hits $100K Milestone Amid Optimism Over Trump Policies  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  How the UK’s rollback of banking regulations could risk another financial crisis

How the UK’s rollback of banking regulations could risk another financial crisis