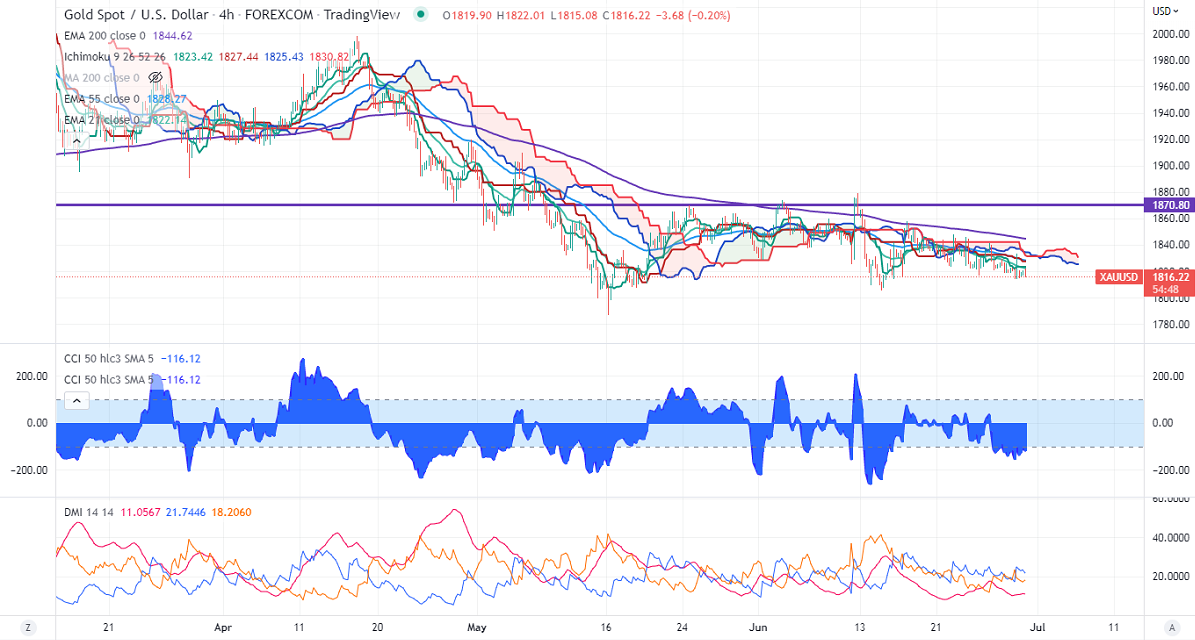

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- $1823.42

Kijun-Sen- $1827.44

Gold price lost its shine and declined more than $15 from yesterday's high of $1833. US dollar index gained sharply despite weak US GDP data. It shrinks by 1.6% in the first quarter of 2022 compared to a forecast of -1.5%. Markets eye the US PCE price index and personal income for further direction. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Jul dropped to 85.6% from 93.3% a week ago. It hits a low of $1818 and is currently trading around $1819.94.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index – Bullish (Negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1815, a breach below targets $1800/$1750. Significant reversal only below $1750. A dip to $1700/$1689 is possible. The yellow metal faces minor resistance around $1850, any breach above will take to the next level $1875/$1900/$1920.

It is good to sell on rallies around $1838-40 with SL around $1875 for TP of $1800/$1787.