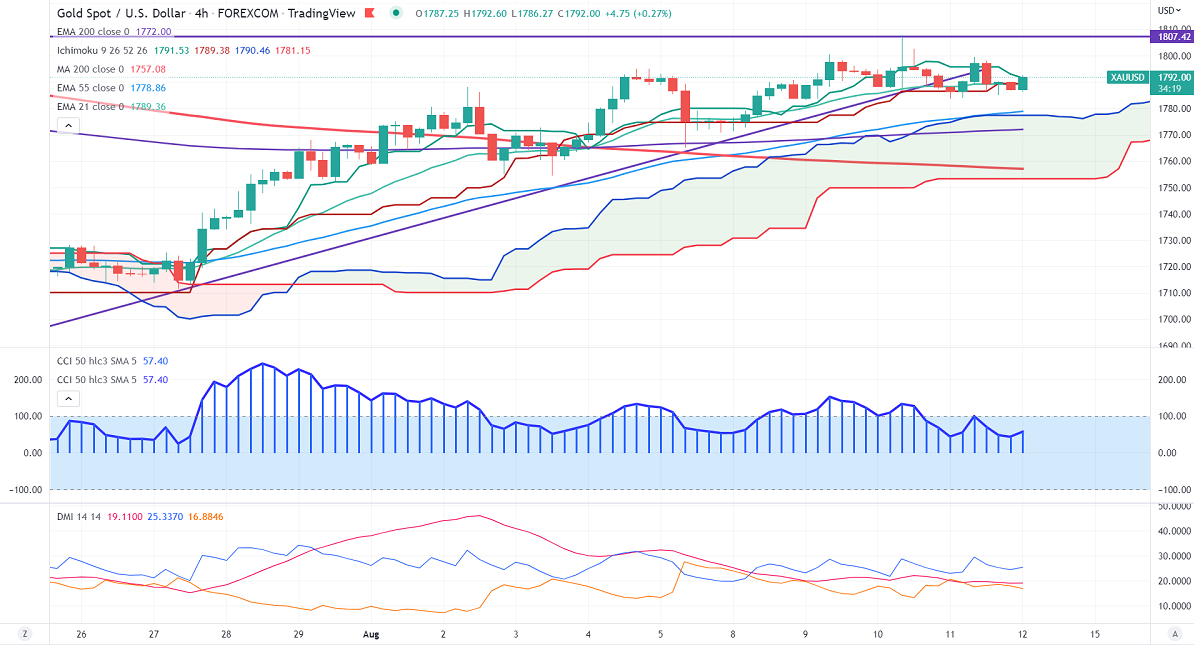

Ichimoku Analysis (4- hour Chart)

Tenken-Sen- $1793.06

Kijun-Sen- $1789.38

Gold price regained after a minor decline to $1783 on weak US PPI data. It fell by 0.5% in July for the first time since the COVID pandemic compared to a forecast of 0.2%. US dollar index halted its weak trend and showed a pullback above 105 despite the PPI miss. Markets eye geopolitical tension between China and Taiwan for further direction.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep dropped to 37.5% from 42% a day ago.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1780, a breach below targets $1760/$1750/$1740. Significant reversal only below $1650. The yellow metal faces minor resistance around $1800, breach above will take it to the next level of $1820/$1840.

It is good to buy on dips for around $1770 with SL at around $1750 for TP of $1825.