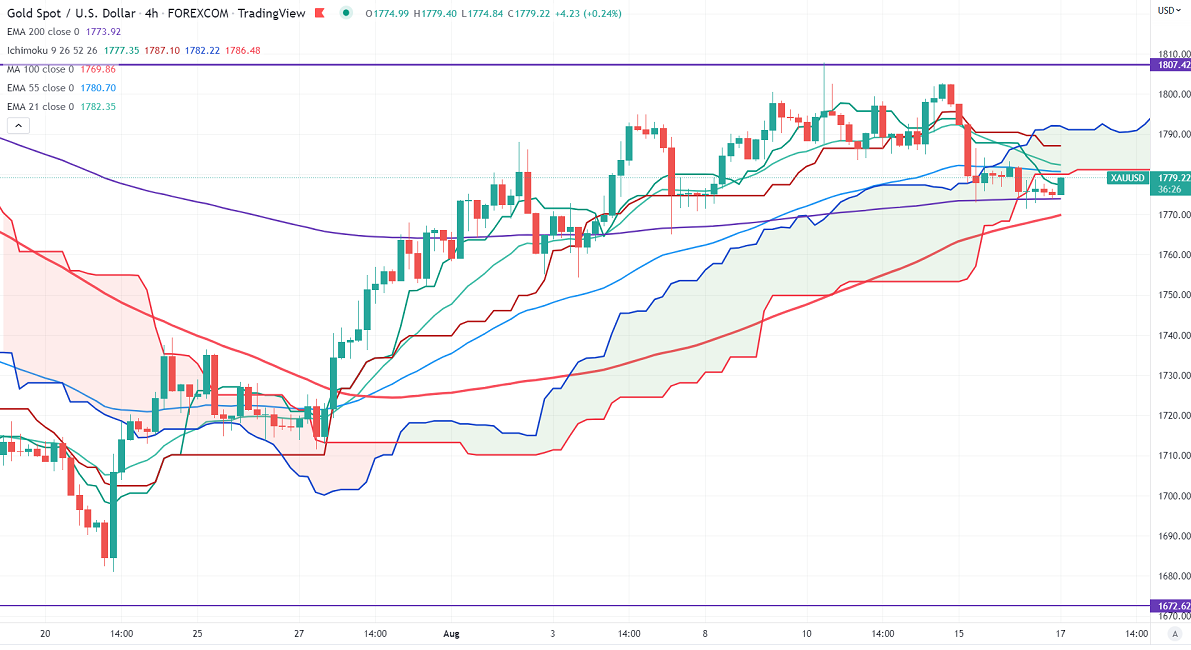

Ichimoku Analysis (4-hour Chart)

Tenken-Sen- $1777.83

Kijun-Sen- $1787.10

Gold price trades flat after a minor selloff. Geopolitical tension and recession fears are supporting the yellow metal at lower levels. US housing starts dropped 9.6% and hit 1-1/2 year low and building permits fell by 1.3%. Market eyes US retail sales data for further direction.

US dollar index pared some of its gains ahead of Fed meeting minutes. Any break below 106 confirms intraday bearishness.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Sep dropped to 57.5% from 61% a day ago.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Mixed (Neutral for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1770, a breach below targets $1760/$1750/$1740. Significant reversal only below $1650. The yellow metal faces minor resistance around $1820, breach above will take it to the next level of $1840/$1860/$1870.

It is good to buy on dips for around $1770 with SL at around $1750 for TP of $1825.