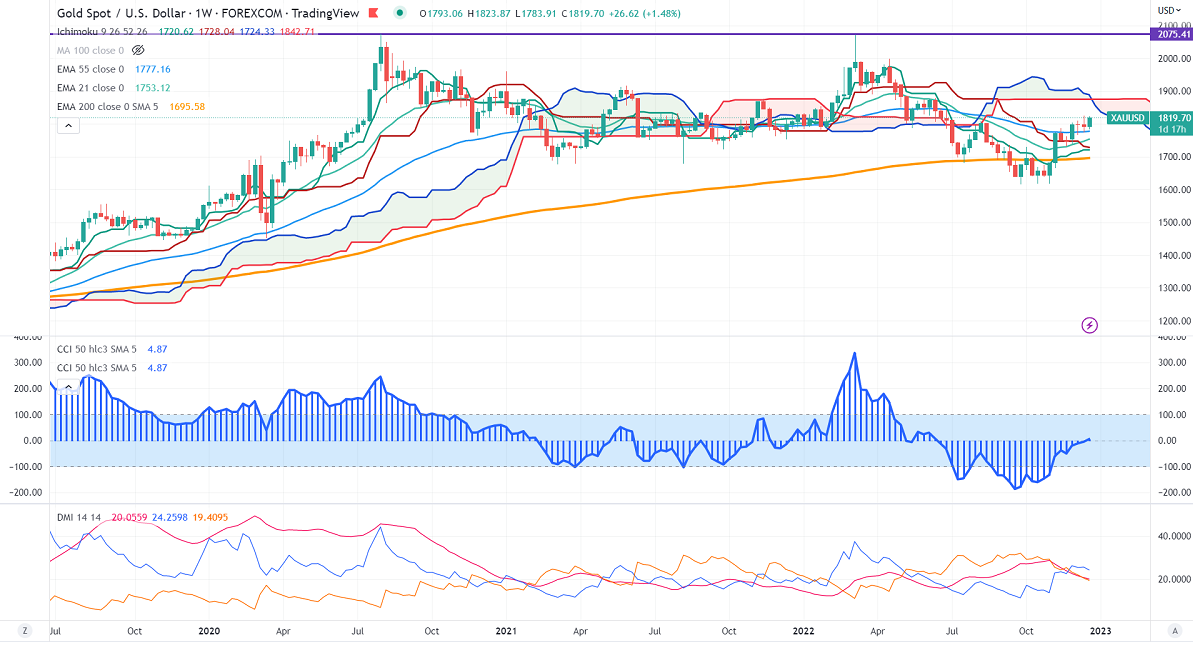

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- $1720.62

Kijun-Sen- $1731.42

Gold holds above $18500 on board-based US Dollar weakness. The US dollar index pared its minor gains after a minor pullback of 104.38. The sudden increase in COVID cases across the globe has increased demand for safe-haven assets like gold. The yellow metal hits a high of $1823.87 and is currently trading around $1819.85.

US dollar index- Bearish. Minor support around 103.40/102. The near-term resistance is at 104.60/106.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec rose to 73.6% from 61.4% a week ago.

The US 10-year yield showed a minor profit booking. The US 10 and 2-year spread narrowed to -55.8 basis points from -85 bpbs.

Factors to watch for gold price action-

Global stock market- Bearish (Positive for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1780, a break below targets of $1760/$1740/$1720/$1700. The yellow metal faces minor resistance around $1820, breach above will take it to the next level of $1860/$1900.

It is good to buy on dips around $1780 with SL around $1760 for TP of $1860.