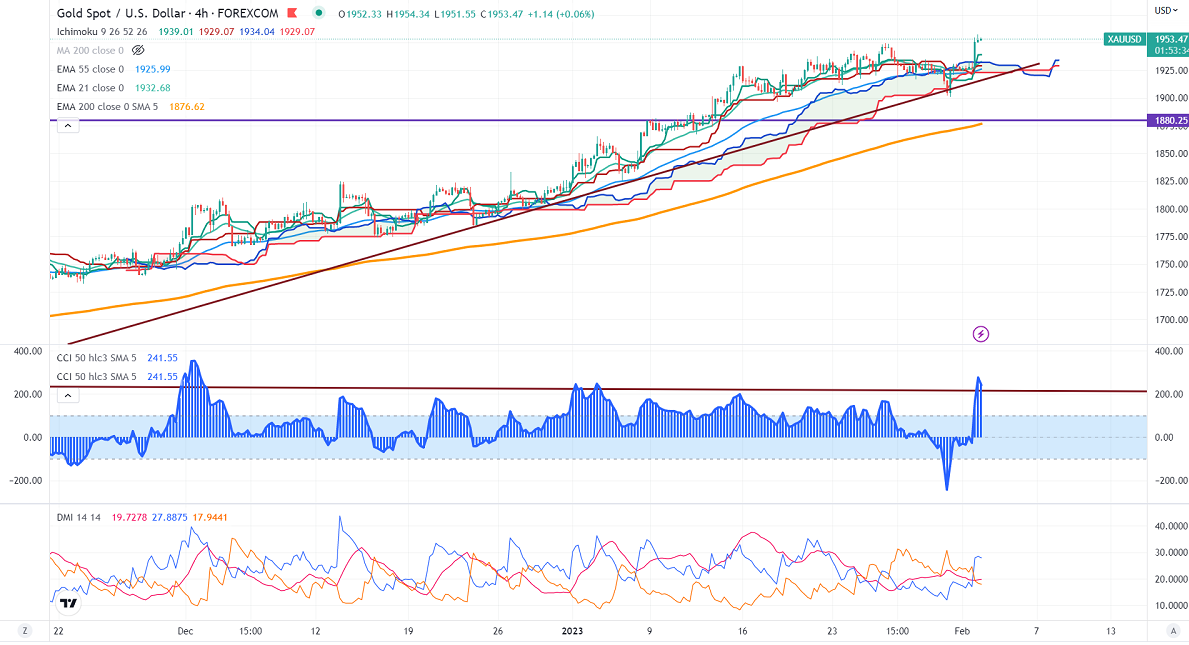

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1938.95

Kijun-Sen- $1929.07

Gold jumped sharply after the dovish Fed rate hike. The central bank raised rates by 25 bpbs and promises further small rate hikes in the coming months. It has mentioned, "Inflation has eased somewhat but remains elevated." It hits a high of $1957 and is currently trading around $1953.26

US ISM manufacturing PMI dropped to 47.4 last month, below the estimate of 48. US private payroll growth slowed to 106000 in January compared to a forecast of 176000.

US dollar index- Bearish. Minor support around 100/. The near-term resistance is 103.50/104.50.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in Feb dropped to rose to 97.6 from 98.60% a week ago.

The US 10-year yield is trading flat ahead of policy. Any break and close below 3.26% confirm minor bearishness. The yield spread between 10 and 2-year narrowed to -69.80 basis points from -75 bpbs.

Factors to watch for gold price action-

Global stock market- bullish (Negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1944, a break below targets of $1920/$1900.The yellow metal faces minor resistance around $1960, and a breach above will take it to the next level of $2000/$2025.

It is good to buy on dips around $1920-21 with SL around $1900 for TP of $2000.