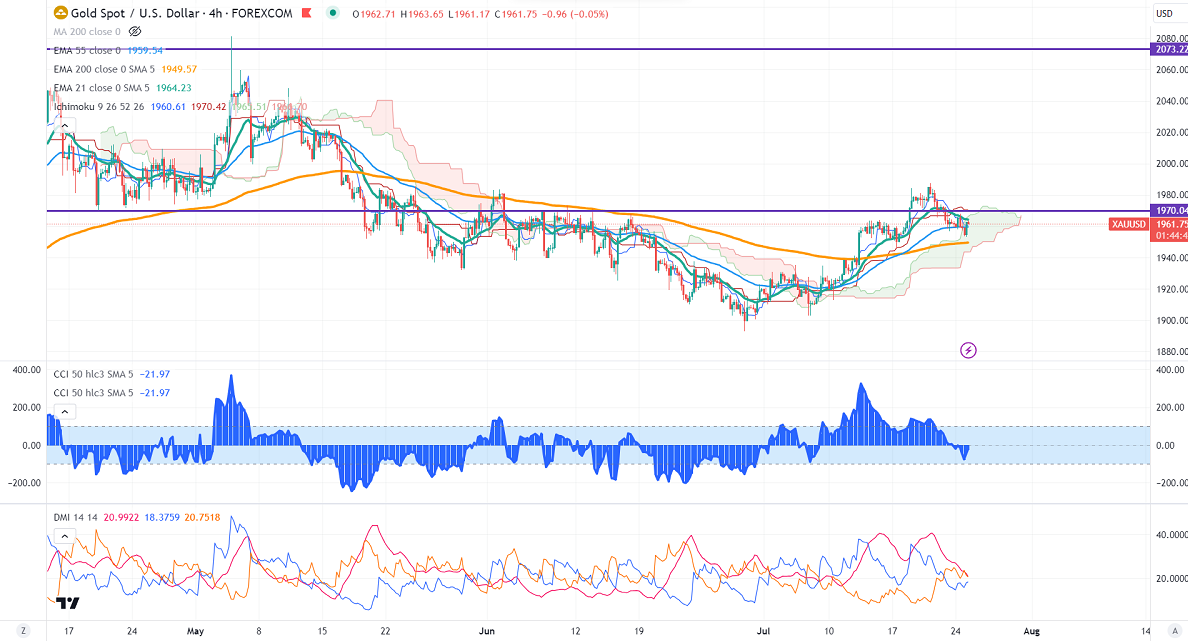

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1960.61

Kijun-Sen- $1970.42

Gold prices showed a minor pullback after a massive sell-off. It hits a low of $1953.30 and currently trading around $1962.03.

US July flash S&P manufacturing PMI slowed down to a five-month low at 49, compared to a forecast of 46.10.

Jul 25th, 2023, German Ifo business climate (12:30 pm GMT)

CB consumer confidence and Richmond manufacturing Index (2:00 pm GMT)

US dollar index- Bullish. Minor support around 100.60/99.50. The near-term resistance is 102/103.

According to the CME Fed watch tool, the probability of a 25 bpbs rate hike in July increased to 98.90% from 98% a week ago.

The US 10-year yield trades flat ahead of US-fed monetary policy. The US 10 and 2-year spread narrowed to -97.80% from -110%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bullish (bearish for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1950, a break below targets of $1945/1930. The yellow metal faces minor resistance around $1965, and a breach above will take it to the next level of $1980/$2000.

It is good to buy on dips around $1950 with SL around $1938 for TP of $1990/$2000.