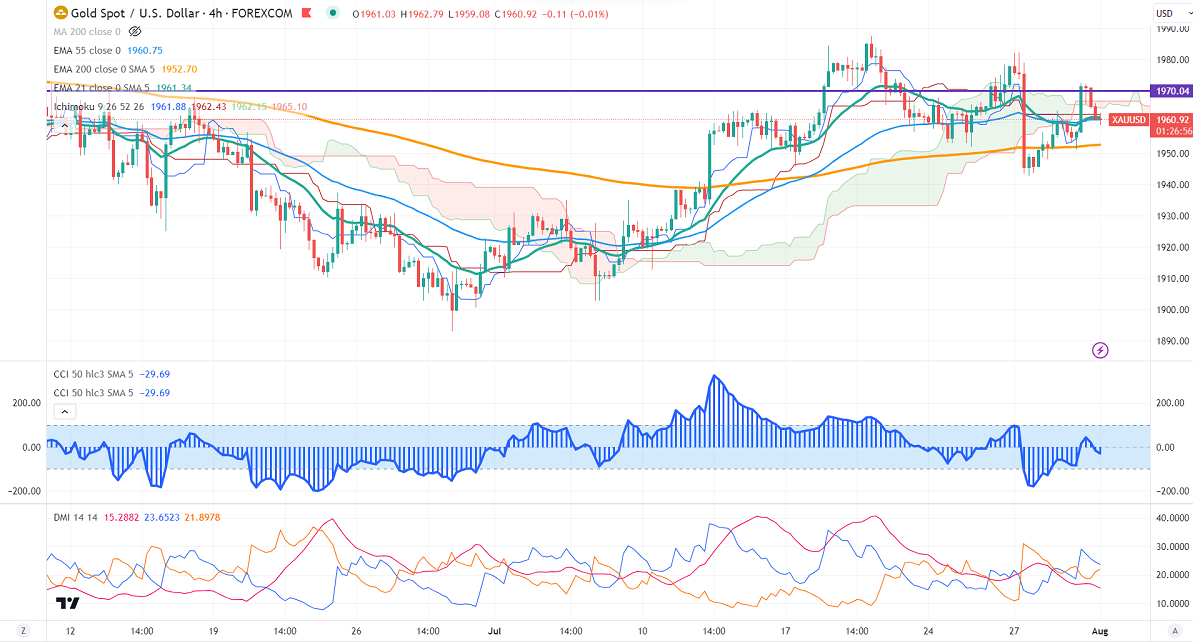

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1962.43

Kijun-Sen- $1961.88

Gold showed a nice pullback amid the weak US dollar. It hits a high of $1972 and is currently trading around $1960.96.

According to a flash estimate for Eurostat, Eurozone inflation declined to 5.3% in Jul, in line with the estimate. Core CPI surged to 5.5% vs a forecast of 5.4%. Chicago PMI jumped slightly to 42.8 in Jul, below the estimate of 43.

Major economic data for the day

Aug 1st, 2023, US ISM manufacturing PMI (2:00 pm GMT)

US dollar index- Bullish. Minor support around 100.60/99.50. The near-term resistance is 102.20/103.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 82.50% from 81.60% a week ago.

The US 10-year yield trades flat ahead of the US ISM manufacturing PMI. The US 10 and 2-year spread narrowed to -90.30 from -110%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bullish (bearish for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1950, a break below targets of $1940/ $1930/$1920. The yellow metal faces minor resistance around $1975 and a breach above will take it to the next level of $1987/ $2000/$2020.

It is good to sell on rallies around $1970-72 with SL around $1985 for TP of $1900.