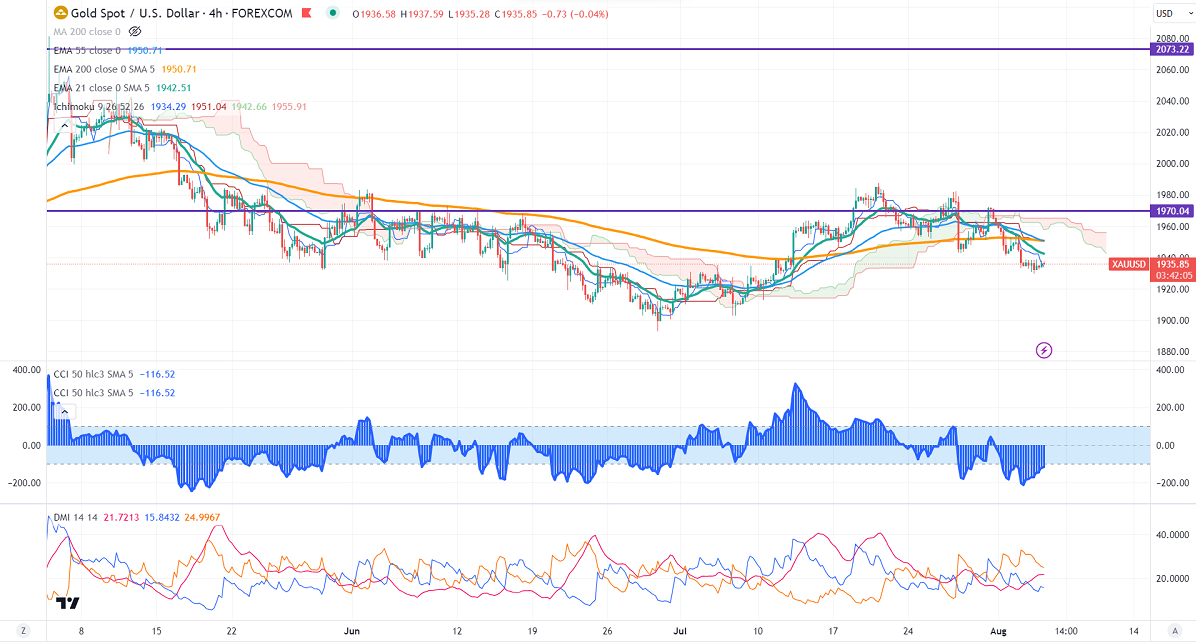

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1955.91

Kijun-Sen- $1940.30

Gold trading flat ahead of US Non-farm payroll. It hits a low of $1929.60 and is currently trading around $1936.09.

Bank of England hiked rates by 25 bpbs as expected to 5.25% to tackle inflation. The central bank said it would keep rates higher until UK inflation comes under control.

The number of people who have filed for unemployment benefits rose by 6000 to 227000 in the week ending July 29, in line with an estimate 226000.

Aug 4th, 2023, Non-farm employment change (12:30 pm GMT)

Unemployment rate(12:30 pm GMT)

US dollar index- Bullish. Minor support around 102/101. The near-term resistance is 103/104.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 82.50% from 78% a week ago.

The US 10-year yield gained sharply ahead of US NFP data. The US 10 and 2-year spread narrowed to -73.10 from -110%.

Factors to watch for gold price action-

Global stock market- bullish (negative for gold)

US dollar index - Bullish (bearish for gold)

US10-year bond yield- Bearish (negative for gold)

Technical:

The near–term support is around $1930, a break below targets of $1920/$1900. The yellow metal faces minor resistance around $1940 and a breach above will take it to the next level of $1955/$1970/$1985.

It is good to sell on rallies around $1950 with SL around $1960 for TP of $1900.