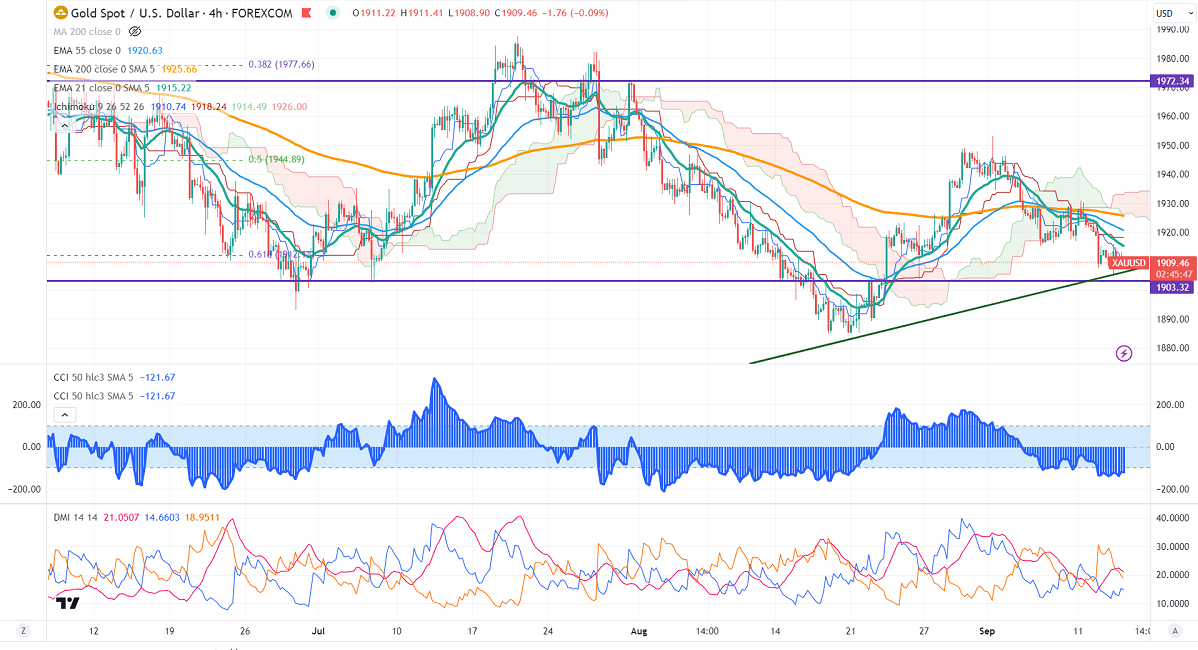

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1910.74

Kijun-Sen- $1918.24

Gold showed a minor sell-off after US CPI data. It hit a low of $1905 and is currently trading around $1909.97.

US Headline inflation rose 3.7% y/y vs. 3.2% in July. Core CPI surged to 0.60% last month, the largest gain since June 2022.

US dollar index- Neutral. Minor support around 104.40/103.79. The near-term resistance is 105/106.

According to the CME Fed watch tool, the probability of a no-rate hike in Sep increased to 97% from 92% a week ago.

The US 10-year yield pared some of its despite strong US CPI. The US 10 and 2-year spread widened to -73% from -57%.

Factors to watch for gold price action-

Global stock market- mixed (neutral for gold)

US dollar index - Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1900, a break below targets of $1880/$1870/$1850. The yellow metal faces minor resistance around $1920 and a breach above will take it to the next level of $1930/$1950/.

It is good to sell on rallies around $1920-21 with SL around $1931 for TP of $1880/$1860.