FxWirePro- Gold Daily Outlook

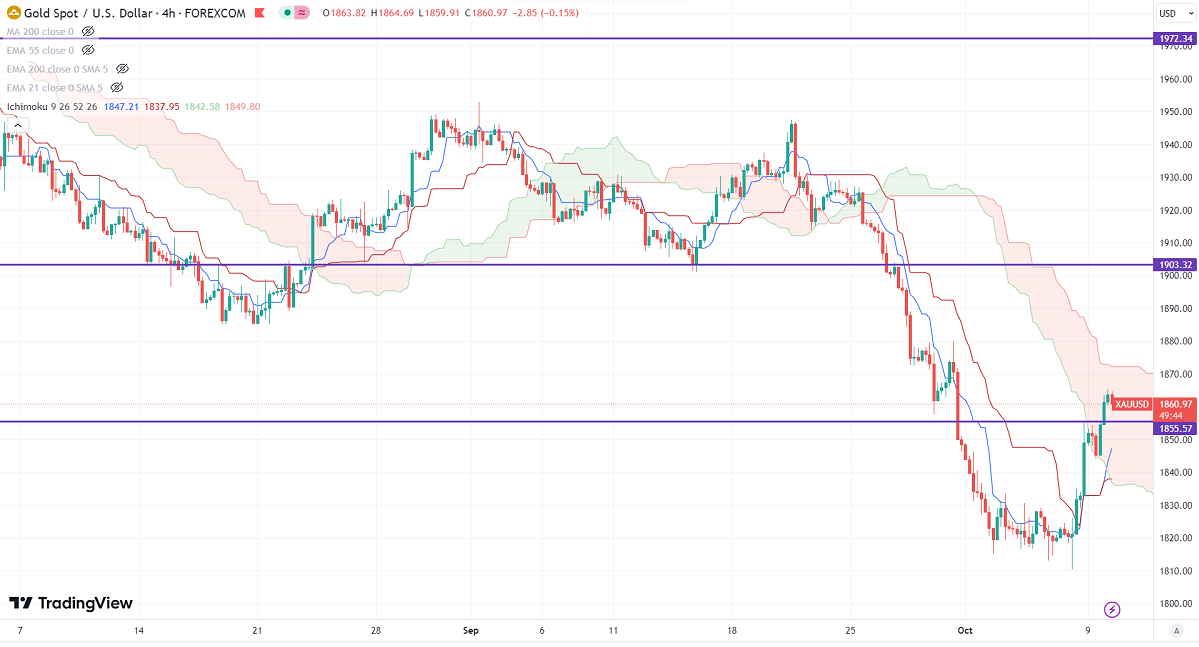

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1843.20

Kijun-Sen- $1837.90

Gold trades above $1850 as demand for haven assets increases. It hit a high of $1865.39 and is currently trading at around $1862.08.

The escalating conflicts in the Middle East support the yellow metal at lower levels. The Israel and Palestine war continued for a third day and almost 700 Israelis and 600 people died in Gaza.

US dollar index- Neutral. Minor support around 105.80/105. The near-term resistance is 106.50/107.50.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 86.40% from 72.80% a week ago.

The US 10-year yield pared more than 5% on geopolitical tension. The US 10 and 2-year spread narrowed to -32% from -75%.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index - Mixed (neutral for gold)

US10-year bond yield- Mixed (neutral for gold)

Technical:

The near–term support is around $1830, a break below targets of $1800/$1785/$1760. The yellow metal faces minor resistance around $1870 and a breach above will take it to the next level of $1885/$1900.

It is good to buy on dips around $1850-51 with SL around $1830 for TP of $1900.