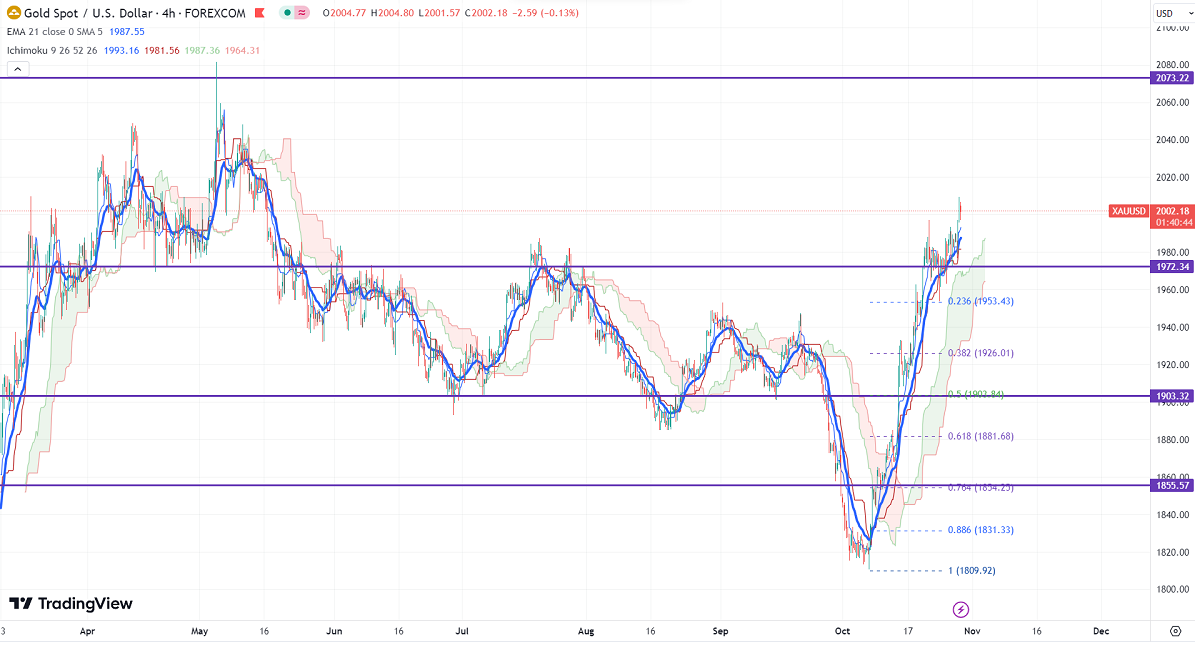

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1990.67

Kijun-Sen- $1981.50

Gold surged above $2000 as geopolitical tension escalated. It hit a high of $2009 yesterday and is currently trading at around $2002.06.

US GDP grew at an annualized rate of 4.9% in the third quarter, compared to a forecast of 4.50%. US durable goods orders rose 4.7% m/m due to a surge in aircraft sales vs an Estimate of 1.9%. US new home sales jumped to a 19-month high of 759K in Sep compared to a forecast of 680K.

The annual Core PCE index rose 3.7% from 3.8% the previous month. The PCE price index rose 0.30% m/m in line with the estimate. UoM consumer sentiment revised to 63.8 vs. 63 expected.

European Central Bank has kept its rates unchanged at 4%. The central bank also pointed out that inflation is slowly coming down to its target of 2%.

Major Economic data for the day

Oct 31st, 2023, Employment cost index q/q (12:30 pm GMT)

S&P/CS Composite -20 HPI y/y (1 pm GMT)

Chicago PMI and CB consumer confidence (1:45 and 2 p.m. GMT)

Nov 1st, 2023, US ISM Manufacturing PMI (2 pm GMT)

Federal funds rate (6 pm GMT)

Nov 2nd, 2023, BOE monetary policy (noon GMT)

Nov 3rd, 2023, US Nonfarm payroll (12:30 pm GMT)

US dollar index- Bullish. Minor support around 105/104.50. The near-term resistance is 107.50/109.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 99.5% from 97.60% a day ago.

The US 10-year yield pared some of its gains despite strong US GDP data. The US 10 and 2-year spread narrowed to -19.20% from -75%.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index - Bullish (Negative for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

The near–term support is around $1975, a break below targets of $1960/$1950/$1926. The yellow metal faces minor resistance around $2000 and a breach above will take it to the next level of $2020/$2048.

It is good to buy on dips around $1970-72 with SL around $1960 for TP of $2000/$2020.