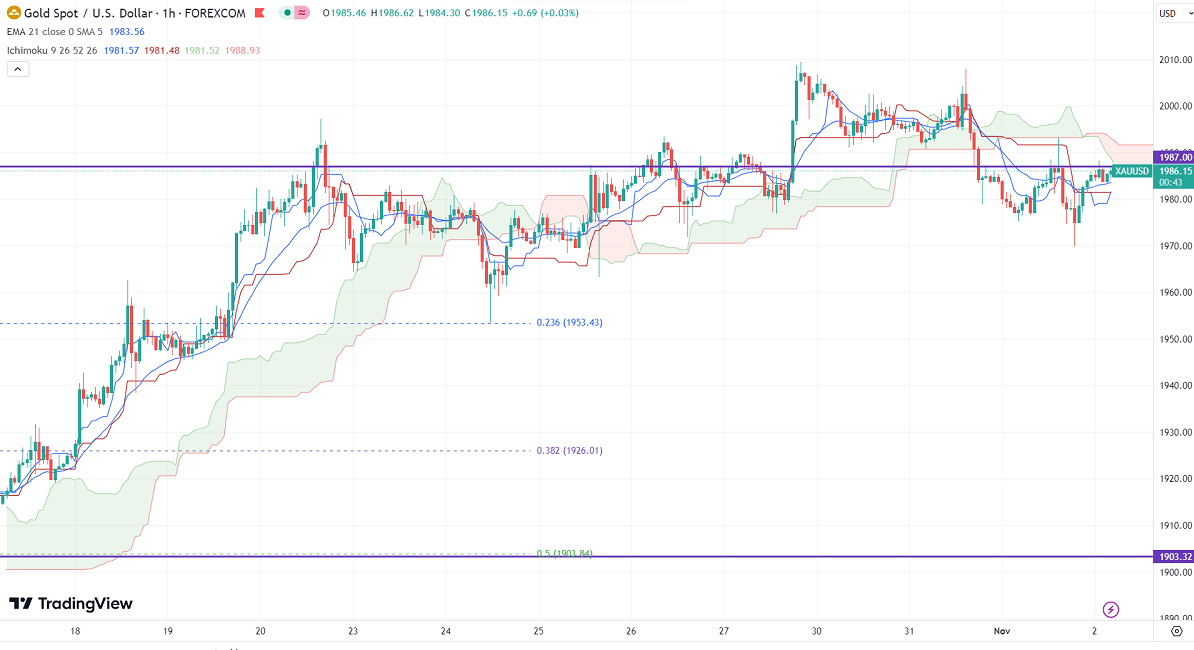

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1993.06

Kijun-Sen- $1990.67

Gold pared some of its gains after Fed monetary policy. It hit a low of $1969.91 yesterday and is currently trading around $1985.77.

FOMC has kept its rates unchanged at 5.50% as expected. It has maintained the current pace of QT. The central bank said that inflation is elevated and has kept doors open to hike rates depending on economic developments.

US ISM manufacturing PMI declined to 46.70 in Oct, compared to a forecast of 49. Private sector payroll surged 113000 in Oct vs. Estimate of 149000.

Major Economic data for the day

Nov 2nd, 2023, BOE monetary policy (12:30 pm GMT)

US dollar index- Bullish. Minor support around 105/104.50. The near-term resistance is 107.50/109.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov decreased to 97.70% from 99.20% a week ago.

The US 10-year yield trades higher ahead of Fed monetary policy. The US 10 and 2-year spread narrowed to -16.7% from -75%.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index - Bullish (Negative for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

The near–term support is around $1975, a break below targets of $1960/$1950/$1926. The yellow metal faces minor resistance around $2010 and a breach above will take it to the next level of $2020/$2048.

It is good to buy on dips around $1970-72 with SL around $1960 for TP of $2000/$2020.