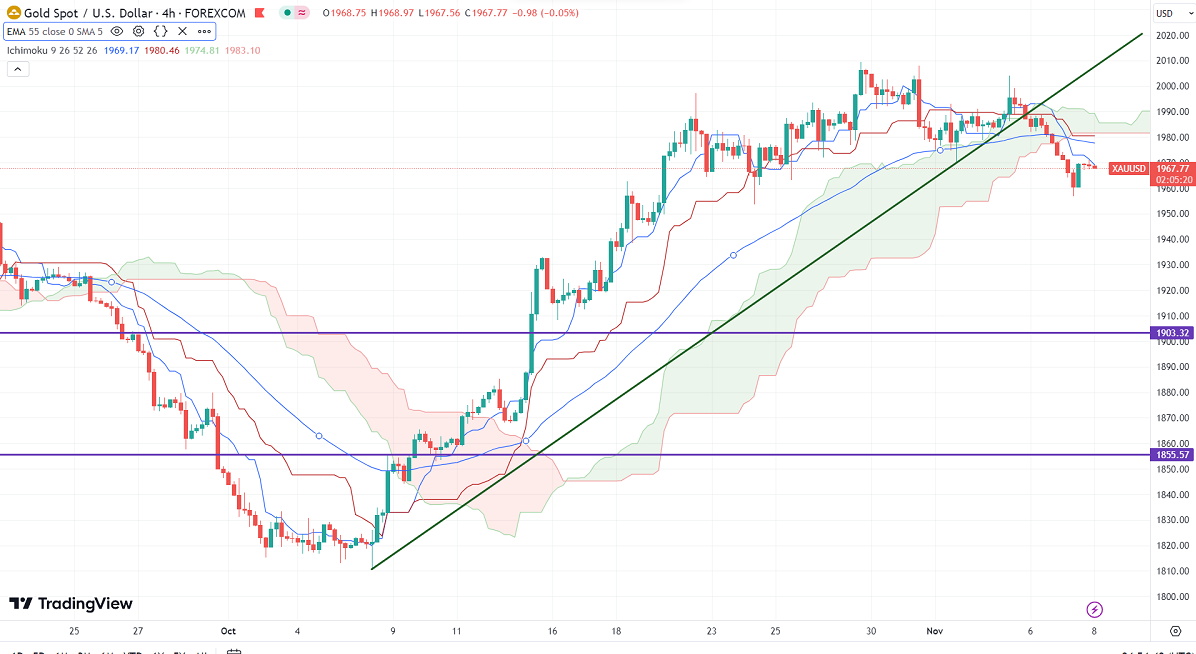

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1971.36

Kijun-Sen- $1980.46

Gold trades weak for the second consecutive day on board-based US dollar buying. It hit a low of $1956.78 and is currently trading around $1967.74.

The easing geopolitical tension has decreased demand for safe-haven assets like gold. Markets eye the Fed chairman's speech today for further movement.

Major Economic data for the day

Nov 8th, 2023, Fed Chair Powell Speaks (2:15 pm GMT)

US dollar index- Bearish. Minor support around 104.80/104. The near-term resistance is 106.25/107.50.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 90.4% from 68.90% a week ago.

The US 10-year yield pared its gains made yesterday ahead of Fed Powell's speech. The US 10 and 2-year spread widened to -35% from -16%.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index - Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1950, a break below targets of $1926/$1900. The yellow metal faces minor resistance around $2010 and a breach above will take it to the next level of $2020/$2048.

It is good to sell on rallies around $1968-70 with SL around $1980 for TP of $1950/$1930.