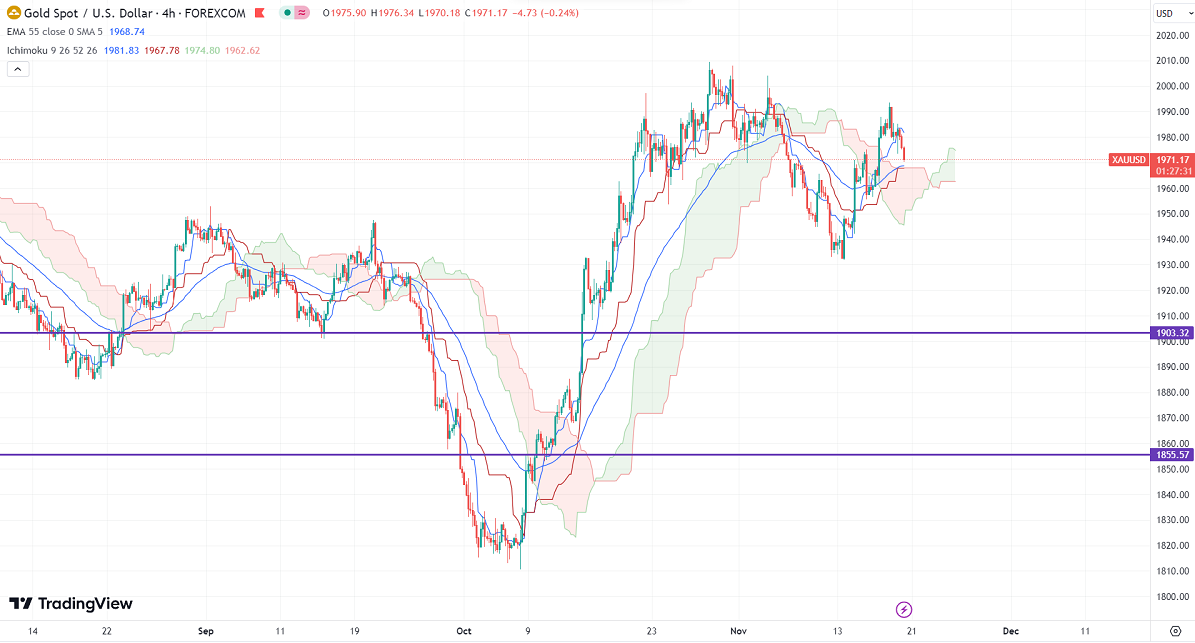

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1972.28

Kijun-Sen- $1959.90

Gold pared some of its gains despite the weak US dollar. It hit a low of $1970.66 and is currently trading around $1970.91.

US CPI for Oct came unchanged, compared to a forecast of 0.10%. On the yearly basis, inflation rose 3.2% below expectations of 3.3%.US PPI rose 1.3% YoY in Oct, compared to a forecast of 2.2%. The annual core PPI surged 2.4% in Oct vs. Forecast of 2.70%. US retail sales dropped 0.10% in Oct from the previous month's 0.90%. Empire State manufacturing index improved to 9.1 in Nov from -4.2 in Oct.

The number of people who have filed for jobless benefits increased by 13000 in the week ending November 11th to 231000, compared to a forecast of 218000.

Major Economic Data for the week

Nov 21st, 2023, US Existing home sales (3 pm GMT)

FOMC Meeting minutes (7 pm GMT)

Nov 22nd, 2023, Durable goods orders, US jobless claims (1:30 pm GMT)

Nov 24th, 2023, US flash manufacturing and services PMI (2:45 pm GMT)

US dollar index- Bearish. Minor support around 103/102. The near-term resistance is 104/105.

According to the CME Fed watch tool, the probability of a no-rate hike increased to 99.8% from 85.50% a week ago.

The US 10-year yield showed a minor pullback of 2%. The US 10 and 2-year spread widened to -42% from -16%.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Weak (positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1950, a break below targets of $1929/$1900/$1850. The yellow metal faces minor resistance around $1975 and a breach above will take it to the next level of $1990/$2000.

It is good to buy on dips around $1970 with SL around $1958 for TP of $2000/$2009.