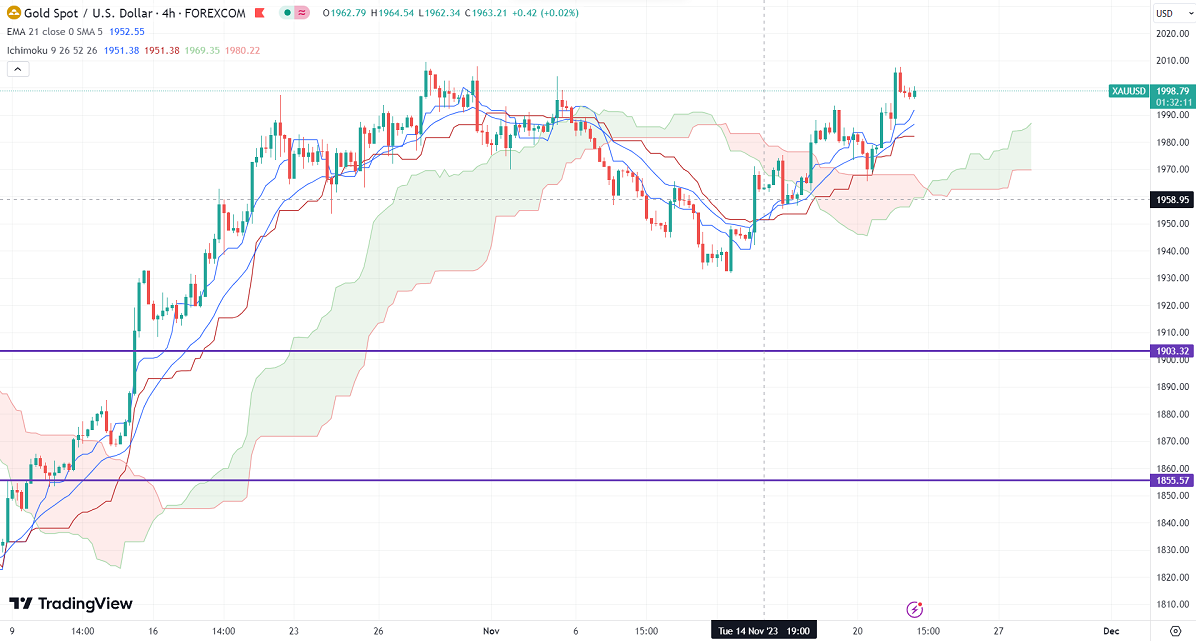

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1988.26

Kijun-Sen- $1982.08

Gold pared some of its gains after the FOMC meeting minutes. It hit a high of $2007 and is currently trading around $1995.

Fed officials unanimously decided to keep the benchmark lending rate unchanged in a range of 5.25% to 5.5%. The Fed members agreed that the central bank would hike rates if incoming data was insufficient.

Major Economic Data for the week

Nov 22nd, 2023, Durable goods orders, US jobless claims (1:30 pm GMT)

US dollar index- Bearish. Minor support around 103/102. The near-term resistance is 104/105.

According to the CME Fed watch tool, the probability of a no-rate hike in Dec decreased to 95% from 99.80% a week ago.

The US 10-year yield trades weak after the hawkish rate pause. The US 10 and 2-year spread widened to -47% from -16%.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Weak (positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1965, a break below targets of $1950/$1929/$1900/$1850. The yellow metal faces minor resistance around $2000 and a breach above will take it to the next level of $2010/$2025.

It is good to buy on dips around $1980-81 with SL around $1968 for TP of $2007.