FxWirePro- Gold Daily Outlook

Gold hits fresh all-time high due to fed rate cut hopes. It hits a high of $2589 and is currently trading around $2584.

Markets eye US Fed monetary policy this week for further direction.

According to the CME Fed watch tool, the probability of a 50 bpbs rate cut in Sep increased to 59% from 30% a week ago.

US dollar index- Bearish. Minor support around 100.50/99.80. The near-term resistance is 101.40/102.

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index - Bearish (Positive for gold)

US10-year bond yield- Bearish (positive for gold)

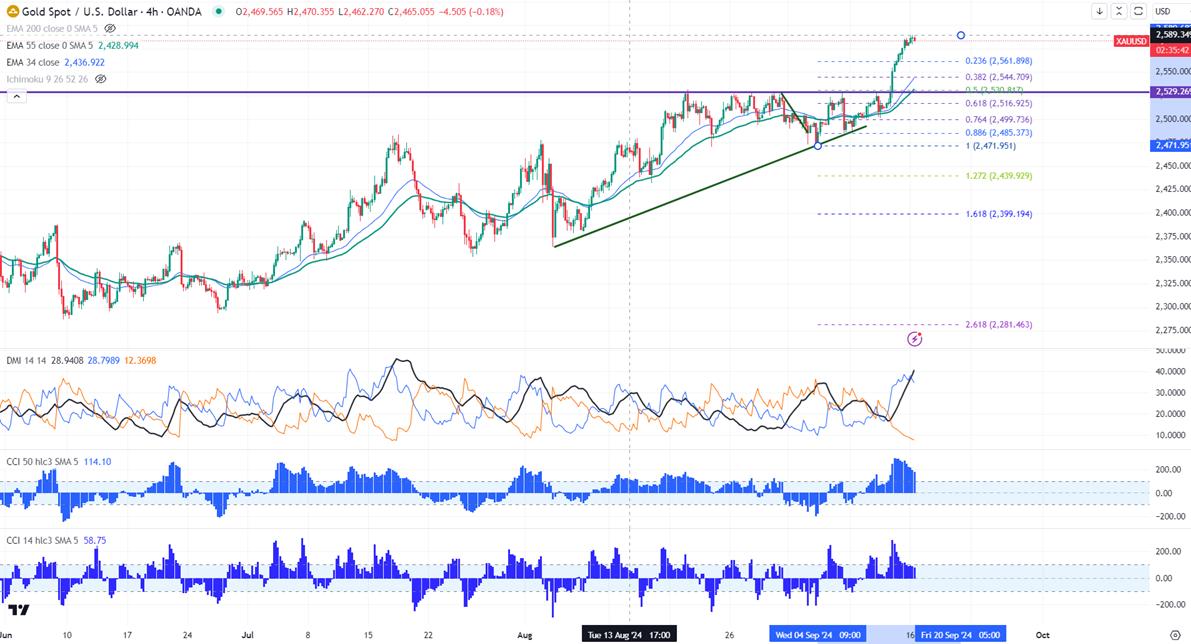

Technical:

The near–term support is around $2560, a break below the target of $2544/$2535/$2520. The yellow metal faces minor resistance around $2590 and a breach above will take it to the next level of $2622/$2650.

Indicator (4-hour chart)

CCI (14)- Bullish

CCI (50)- Bullish

Average directional movement Index - Bullish

It is good to buy on dips around $2560 with SL around $2540 for TP of $2600/$2622.