Gold surged sharply and hit fresh all-time high. It hits a high of $2670 and is currently trading around $2655.

The yellow metal gained momentum after a dovish 50 bpbs rate cut. The weak US economic data and easing US inflation show that the Fed would cut more in the meeting.

According to the CME Fed watch tool, the probability of a 50 bpbs rate cut in Nov increased to 58% from 37% a week ago.

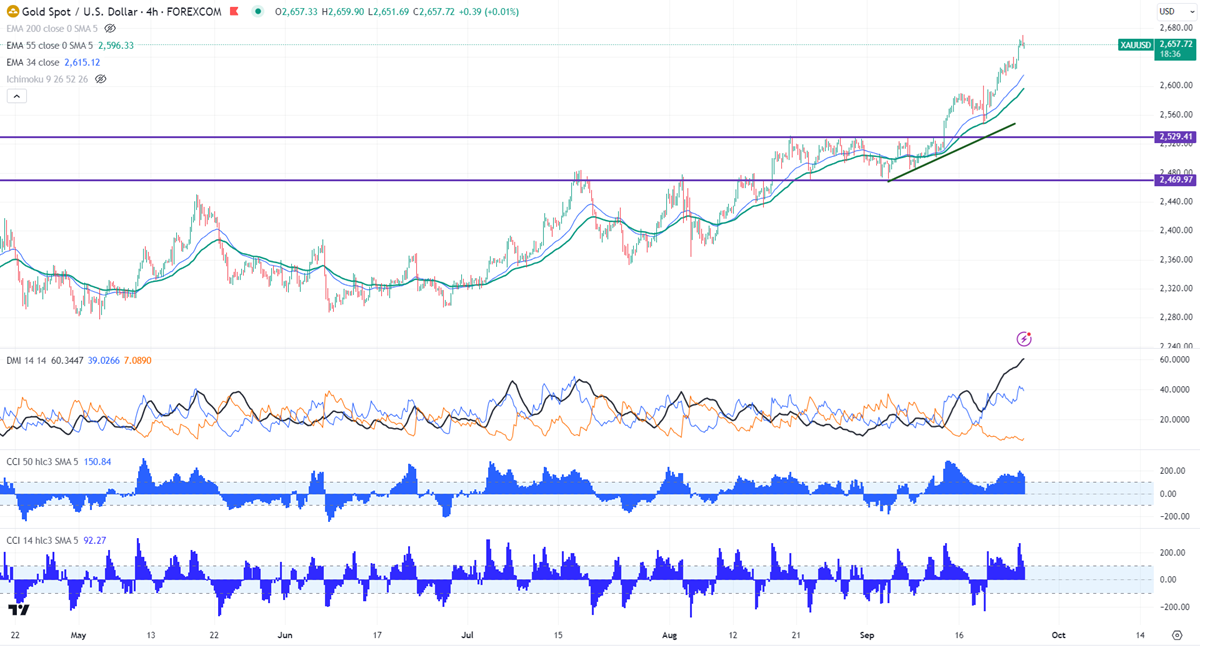

Technical:

The near–term support is around $2640, a break below targets $2620/$2610/$2600/$2570/$2560/$2545/$2520/$2470. Major bearish continuation only below $2470.The yellow metal faces minor resistance around $2670 and a breach above will take it to the next level of $2689/$2700.

Indicator (4- hour chart)

CCI (14)- Bullish

CCI (50)- Bullish

Average directional movement Index - Bullish

It is good to buy on dips around $2634-35 with SL around $2615 for TP of $2700.