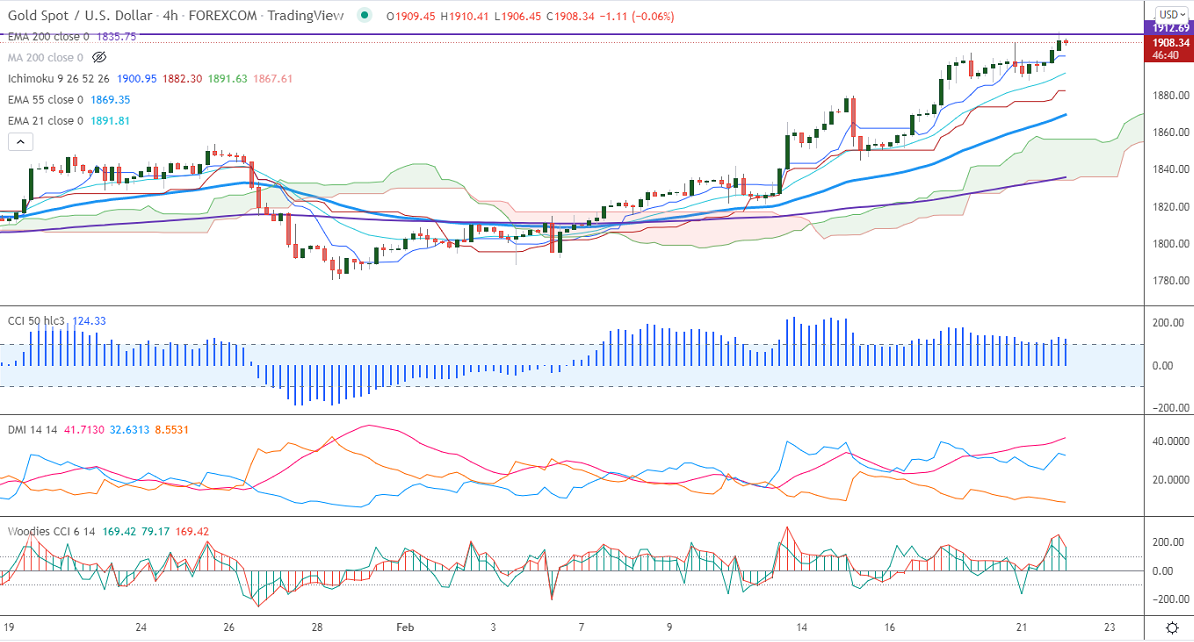

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1900.95

Kijun-Sen- $1882.30

Gold hits fresh eight months high as Russia-Ukraine tension escalated. Russia recognized the independence of separatist regions of Donetsk and Lungask. US 10-year yield cooled off from a multi-month high of 2.06% further supporting the prices of precious metals. Gold hits a high of $1914 and is currently trading around $1907.78.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bullish (negative for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1875, violation below targets $1858/$1840. Significant reversal only below $1750.The yellow metal faces strong resistance of $1920, any violation above will take to the next level $1935/$1960.

It is good to buy on dips for $1880 with SL around $1870 for TP of $1930.