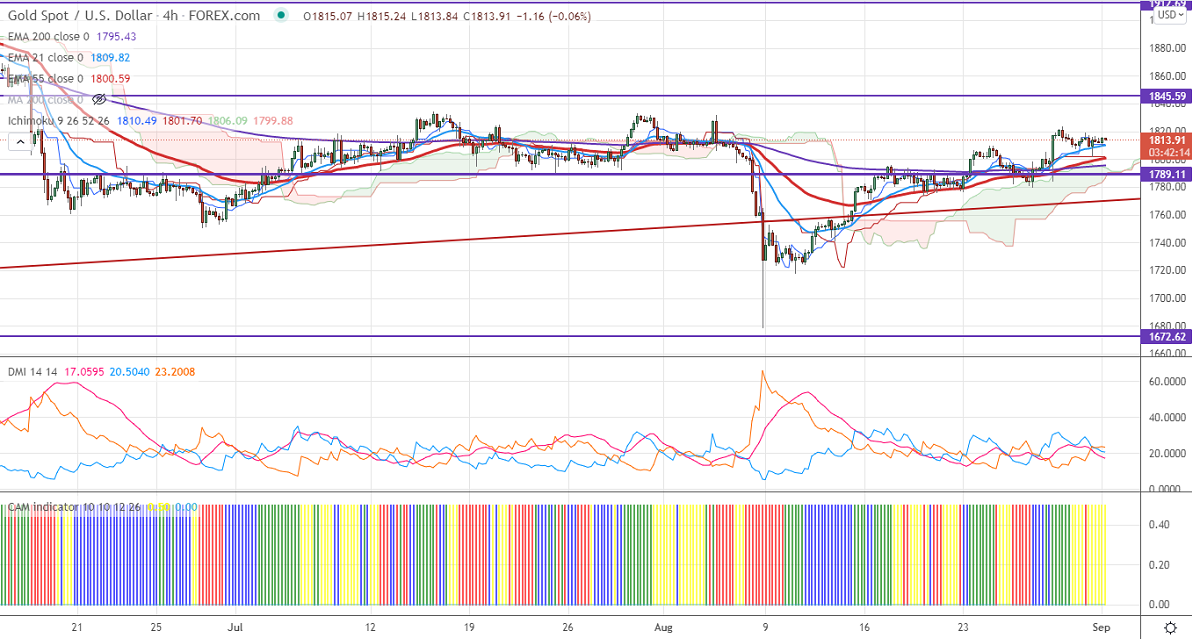

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1810.49

Kijun-Sen- $1801.70

Previous week High- $1795

Previous week low- $1770

Gold is trading in a narrow range between $1774 and $1823 for the past ten days. The US dollar rebounds from yesterday's low of 92.40 despite weak economic data. The US conference board consumer confidence declined to 113.80 in August compared to a forecast of 122.90, the lowest level since Feb. the Chicago PMI dropped to 66.8 in August vs. 68 expected. The US 10-year yield recovered more than 5% is putting pressure on yellow metal at higher levels.

Economic data-

Markets eye US ADP employment data, ISM, manufacturing PMI data for further direction.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Slightly bullish (negative for gold)

Technical:

The immediate resistance is around $1821, a convincing break above will take the yellow metal to $1835/$1850. It is facing strong support at $1770, violation below targets $1750/ $1730/$1700.

It is good to buy on dips around $1800 with SL around $1790 for TP of $1835.