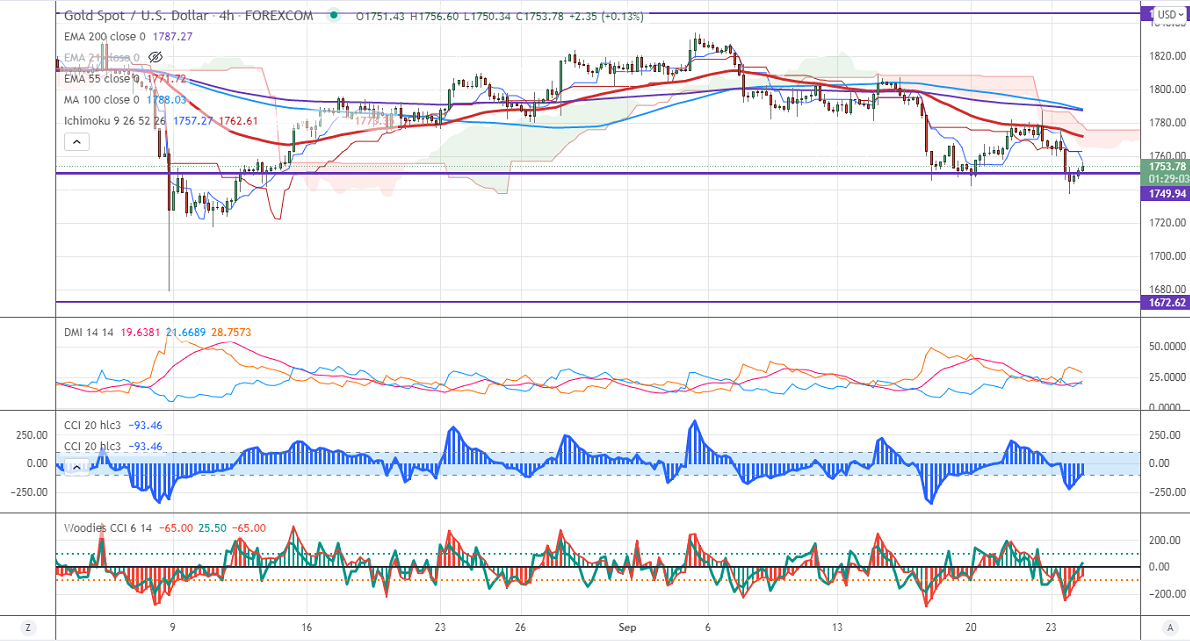

Significant resistance - $1790

Gold is trading weak for second consecutive days and lost more than $50 on surging US treasury yield. The US 10-year yield recovered more than jumped and hits a 2-month high after Fed planned to reduce bond purchases by this year. DXY lost more than 50 pips as markets sentiment turned bullish. Any breach below 92.98 confirms intraday bearishness. The yellow metal hits a low of $1737 and is currently trading around $1752.

Economic data-

The number of people who have filed for unemployment benefits rose to 351000 for the week ended Sep 18th compared to a forecast of 320000.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (positive for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The immediate resistance is around $1760, a convincing break above will take the yellow metal $1775/$1790/$1800. It is facing strong support at $1737 (61.8% fib), violation below targets $$1725/$1700.

It is good to sell on rallies around $1764-65 with SL around $1780 for TP of $1725.