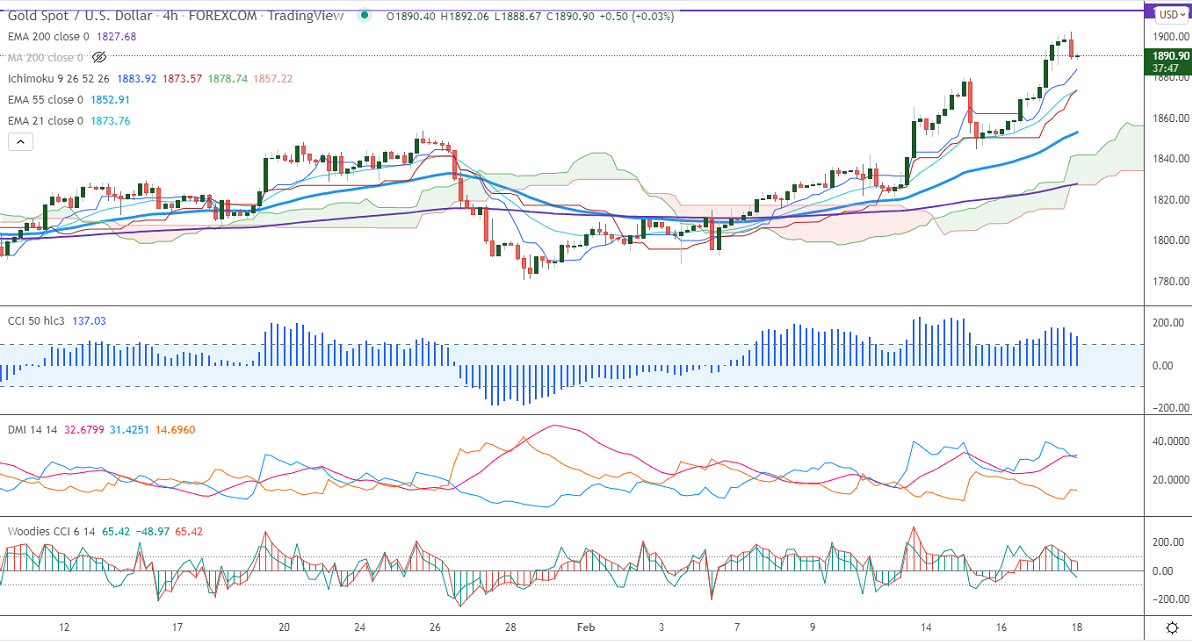

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1880.08

Kijun-Sen- $1871

Gold gained sharply after hitting an 8-month as Russia and Ukraine tension escalates. The exchange of fire between Kyiv's forces and pro-Russian separatists has affected market sentiment. The number of people who have filed for unemployment benefits rose to 248000 the previous week compared to a forecast of 217000. Philly fed manufacturing index dropped to 16.6 in Feb vs. an estimate of 19.90. Gold hits a high of $1902.50 and is currently trading around $1890.45.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1878, violation below targets $1865/$1850/$1840. Significant reversal only below $1750.The yellow metal faces strong resistance of $1905, any violation above will take to the next level $1912/1925 is possible.

It is good to buy on dips for $1860 with SL around $1840 for TP of $1912.